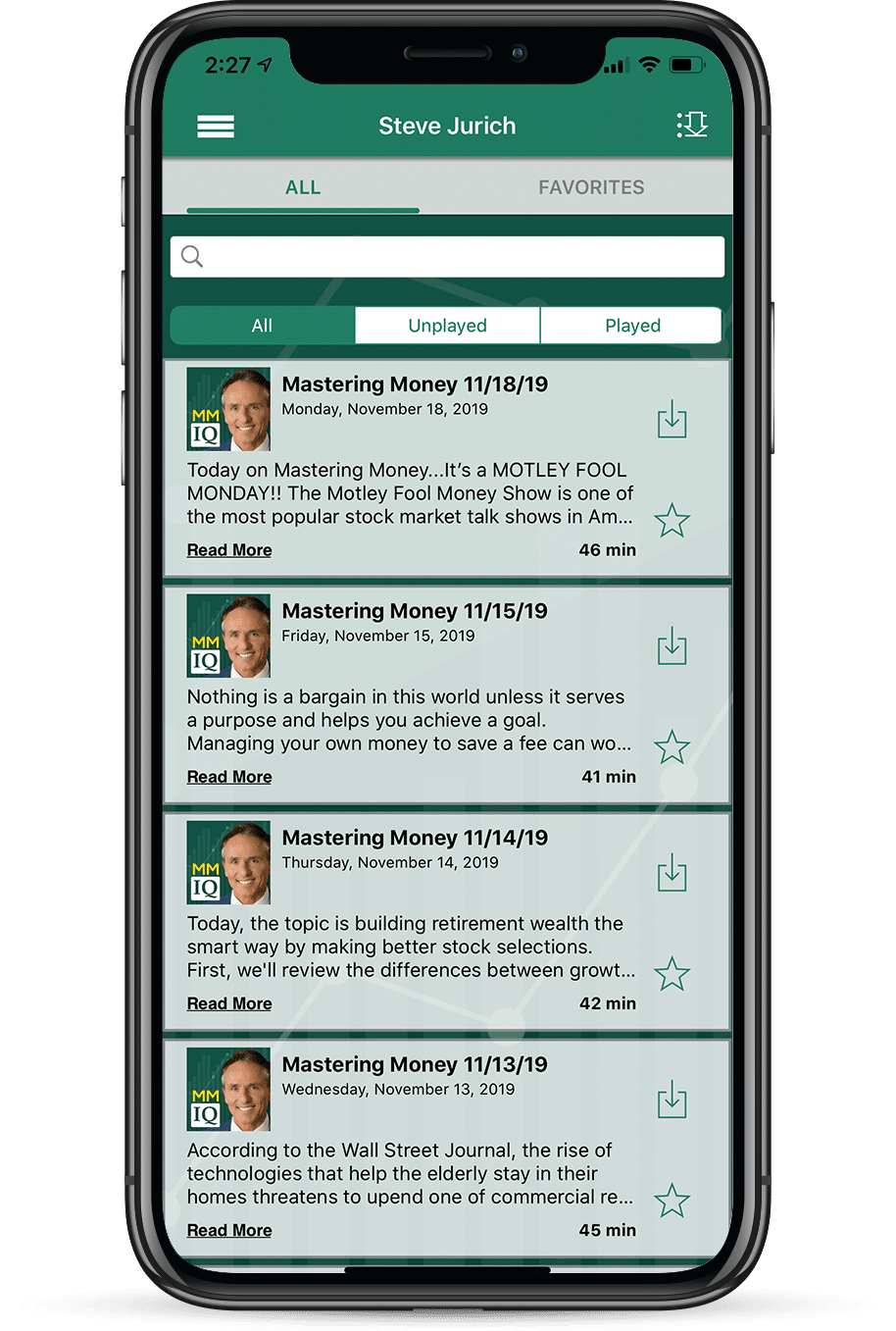

Retirement Radio USA - Podcasts

…In pursuit of a ” Work-Optional Lifestyle?” Learn How To Retire And STAY Retired: Join Scottsdale Financial Planner Steve Jurich, AIF® for The “Common Sense Financial Hour” aka MASTERING MONEY — on Money Radio am 1510 , DAILY at 8am and 11am, with updates M-F at 4:30pm. Podcasts 24/7 on the Mastering Money APP (Android) and i Tunes (Apple). Or, simply visit RetirementRadioUSA.com

Recent Episodes

Mastering Money 4/26/24

Congratulations on your retirement! …Now, get to work!! Nearly double the number of retirees are returning to work full time or part time reports the Wall Street Journal. We’ll review that report in the Market Intel segment and tell you why—then health insurance and Medicare specialist Shelley Grandidge joins us for the Q & A on health insurance and Medicare. A timely show–MASTERING MONEY is on the air!!! #retire #retirement #annuities #insurance #Medicare

Daily IQ Retirement Brief 4/26/24

Daily IQ Retirement Brief 4/26/24

Mastering Money 4/24/2024

As a million new apartments come on line, the Wall Street Journal reports that sales of apartment buildings were down 68% in November of 2023. Prices paid for apartment properties fell 12%. Rents are falling, vacancies increasing. We’ll have that report in the Market Intel segment, then some deep insights on where smart retirement money is going, and why. MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/24/24

Daily IQ Retirement Brief 4/24/24

Mastering Money 4/23/2024

If you’re worried that artificial intelligence will transform your job, insinuate itself into your daily routines, or lead to wars fought with lethal autonomous systems, you’re a little late—all of those things have already come to pass, says Christopher Mims, the Wall Street Journal’s chief Technology editor. We’ll review his eye-opening report in the Market Intel segment, then Shelley Grandidge joins us for the Q & A. Don’t miss it, MASTERING MONEY is on the air!!

Daily IQ Retirement Brief 4/23/24

Daily IQ Retirement Brief 4/23/24

Mastering Money 4/22/24

Bidenomics! Inflation! China! Digital currency! And, an upcoming Presidential election–a lot is happening in the world these days and it could affect your investments. Who better to comment on timely issues than the great Lou Dobbs? Today, Lou is our special guest host for segments 2 and 3, with commentary from Steve in segments 1 and 4. This is a great podcast you don’t want to miss…MASTERING MONEY is on the air!!

Daily IQ Retirement Brief 4/22/24

Daily IQ Retirement Brief 4/22/24

Mastering Money 4/19/2024

Medicare drug plans are much more affordable this year for millions of Americans, courtesy of those nasty rich taxpayers. We’ll review how the significant savings will work in 2024 and 2025 in the Market Intel segment, then Medicare expert Shelley Grandidge joins us to dig a little deeper in the Q & A. A fact filled show you don’t want to miss, MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/19/24

Daily IQ Retirement Brief 4/19/24

Daily IQ Retirement Brief 4/18/24

Daily IQ Retirement Brief 4/18/24

Mastering Money 4/18/2024

So, in case you haven’t noticed home and auto insurance are up by more than 50% and as much as 60%. What’s going on, and will it be coming back down? Don’t shoot the messenger…we’ve got the Bloomberg report for you in the Market Intel Segment, then we’ll do a deep dive into the U.S. economy, why its hanging in there and why the market can still rise in 2024…MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/17/24

Daily IQ Retirement Brief 4/17/24

Mastering Money 4/17/24

Daily IQ Retirement Brief 4/16/24

Daily IQ Retirement Brief 4/16/24

Mastering Money 4/16/2024

The past few years in the stock market have been focused on momentum stocks–specifically tech and artificial intelligence stocks. Momentum investing is a system of buying stocks that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. We’ll examine that approach versus good old fundamental value investing in the Market Intel Segment, then determine what approach may be better for you. MASTERING MONEY is on the air!!!

Mastering Mney 4/15/24

Bidenomics! Inflation! China! Digital currency! And, an upcoming Presidential election–a lot is happening in the world these days and it could affect your investments. Who better to comment on timely issues than the great Lou Dobbs? Today, Lou is our special guest host for segments 2 and 3, with commentary from Steve in segments 1 and 4. This is a great podcast you don’t want to miss…MASTERING MONEY is on the air!!

Daily IQ Retirement Brief 4/15/24

Daily IQ Retirement Brief 4/15/24

Mastering Money 4/12/24

Congratulations on your retirement! …Now, get to work!! Nearly double the number of retirees are returning to work full time or part time reports the Wall Street Journal. We’ll review that report in the Market Intel segment and tell you why—then health insurance and Medicare specialist Shelley Grandidge joins us for the Q & A on health insurance and Medicare. A timely show–MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/12/24

Daily IQ Retirement Brief 4/12/24

Mastering Money 4/26/24

Congratulations on your retirement! …Now, get to work!! Nearly double the number of retirees are returning to work full time or part time reports the Wall Street Journal. We’ll review that report in the Market Intel segment and tell you why—then health insurance and Medicare specialist Shelley Grandidge joins us for the Q & A on health insurance and Medicare. A timely show–MASTERING MONEY is on the air!!! #retire #retirement #annuities #insurance #Medicare

Daily IQ Retirement Brief 4/26/24

Daily IQ Retirement Brief 4/26/24

Mastering Money 4/24/2024

As a million new apartments come on line, the Wall Street Journal reports that sales of apartment buildings were down 68% in November of 2023. Prices paid for apartment properties fell 12%. Rents are falling, vacancies increasing. We’ll have that report in the Market Intel segment, then some deep insights on where smart retirement money is going, and why. MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/24/24

Daily IQ Retirement Brief 4/24/24

Mastering Money 4/23/2024

If you’re worried that artificial intelligence will transform your job, insinuate itself into your daily routines, or lead to wars fought with lethal autonomous systems, you’re a little late—all of those things have already come to pass, says Christopher Mims, the Wall Street Journal’s chief Technology editor. We’ll review his eye-opening report in the Market Intel segment, then Shelley Grandidge joins us for the Q & A. Don’t miss it, MASTERING MONEY is on the air!!

Daily IQ Retirement Brief 4/23/24

Daily IQ Retirement Brief 4/23/24

Mastering Money 4/22/24

Bidenomics! Inflation! China! Digital currency! And, an upcoming Presidential election–a lot is happening in the world these days and it could affect your investments. Who better to comment on timely issues than the great Lou Dobbs? Today, Lou is our special guest host for segments 2 and 3, with commentary from Steve in segments 1 and 4. This is a great podcast you don’t want to miss…MASTERING MONEY is on the air!!

Daily IQ Retirement Brief 4/22/24

Daily IQ Retirement Brief 4/22/24

Mastering Money 4/19/2024

Medicare drug plans are much more affordable this year for millions of Americans, courtesy of those nasty rich taxpayers. We’ll review how the significant savings will work in 2024 and 2025 in the Market Intel segment, then Medicare expert Shelley Grandidge joins us to dig a little deeper in the Q & A. A fact filled show you don’t want to miss, MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/19/24

Daily IQ Retirement Brief 4/19/24

Mastering Money 4/26/24

Congratulations on your retirement! …Now, get to work!! Nearly double the number of retirees are returning to work full time or part time reports the Wall Street Journal. We’ll review that report in the Market Intel segment and tell you why—then health insurance and Medicare specialist Shelley Grandidge joins us for the Q & A on health insurance and Medicare. A timely show–MASTERING MONEY is on the air!!! #retire #retirement #annuities #insurance #Medicare

Daily IQ Retirement Brief 4/26/24

Daily IQ Retirement Brief 4/26/24

Mastering Money 4/24/2024

As a million new apartments come on line, the Wall Street Journal reports that sales of apartment buildings were down 68% in November of 2023. Prices paid for apartment properties fell 12%. Rents are falling, vacancies increasing. We’ll have that report in the Market Intel segment, then some deep insights on where smart retirement money is going, and why. MASTERING MONEY is on the air!!!

Daily IQ Retirement Brief 4/24/24

Daily IQ Retirement Brief 4/24/24

Mastering Money 4/23/2024

If you’re worried that artificial intelligence will transform your job, insinuate itself into your daily routines, or lead to wars fought with lethal autonomous systems, you’re a little late—all of those things have already come to pass, says Christopher Mims, the Wall Street Journal’s chief Technology editor. We’ll review his eye-opening report in the Market Intel segment, then Shelley Grandidge joins us for the Q & A. Don’t miss it, MASTERING MONEY is on the air!!