Smarter Financial Bucketing

Invest Smarter: Financial Bucketing For RetirementInsure your income, insure your outcomes, invest the rest with purpose®

Insure Your Income, Insure Your Outcomes, Invest The Rest With Purpose®

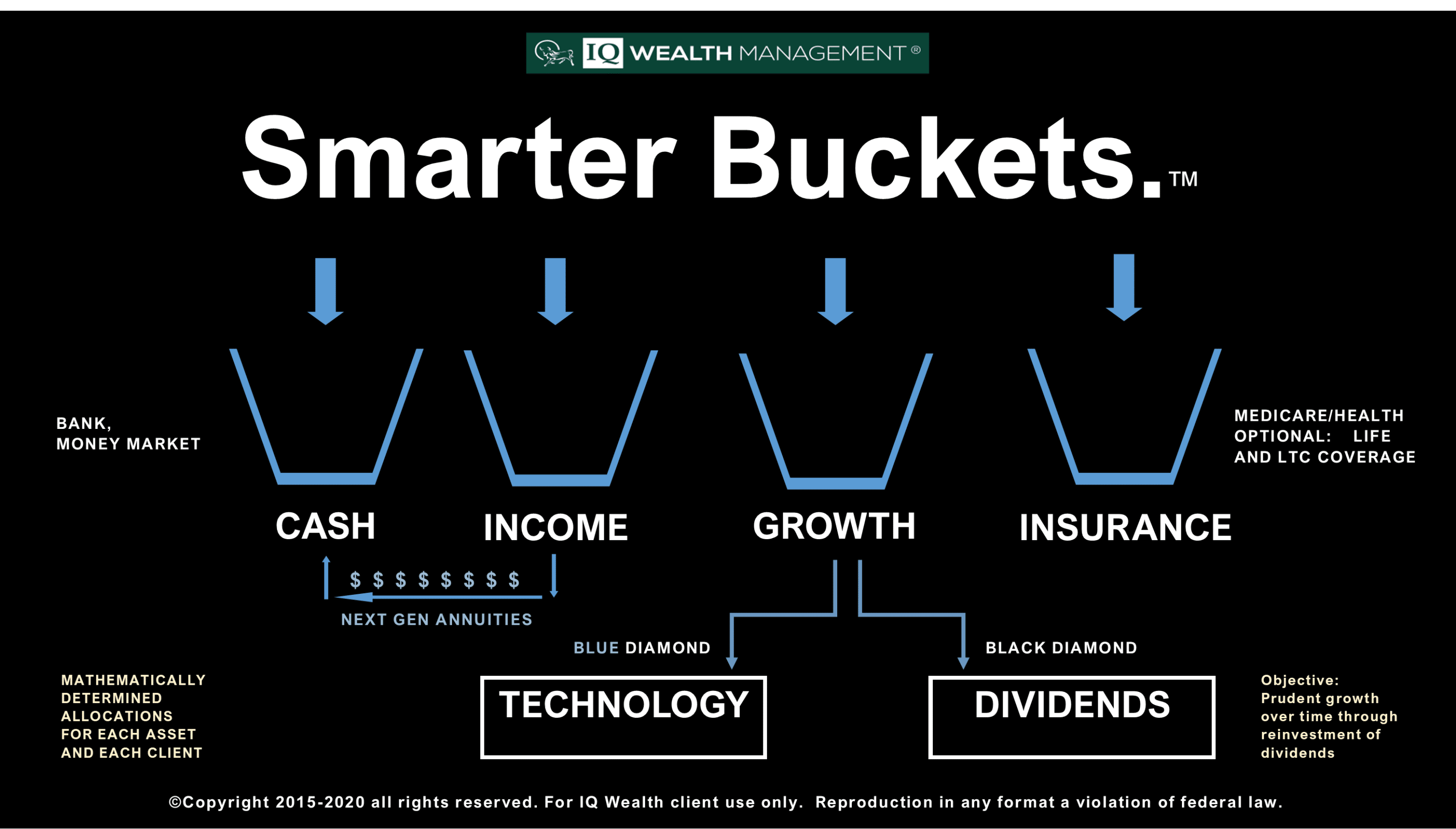

The IQ Wealth Smarter Financial Bucketing System aims to simplify your plan for building, growing, and protecting your retirement money.

Rather than a haphazard, traditional pie-chart approach, Smarter Bucketing™ brings order, discipline, and control to your plan for retirement. Smarter Bucketing™ separates your savings into clear and distinct buckets.

Most important, it establishes a firewall between your income assets and your growth assets, giving every dollar in your portfolio a specific task and time deadline.

We live in a complicated, constantly changing world. The stock market is in unchartered territory. Bonds pay too little to live on. Politics is a mess. And we are learning that Social Security in its current form may not always exist for those with higher “means.”

The IQ Wealth Smarter Bucketing System™ helps you get serious about allocating money for the NEXT twenty years, rather than remaining stuck in your strategy of the PAST twenty years. Plan smarter. Invest smarter. Ensure your outcomes by first insuring your income. Our team will be happy to put you in the driver’s seat to a more worry-free retirement.

Plan Smarter: Allocate Your Retirement Dollars To The IQ Wealth Financial Bucketing System ™

IQ Wealth Smarter Bucketing™ provides for:

- Ample, ready liquid cash to handle essential living expenses-plus money for travel and recreation

- Secure, reliable income contractually guaranteed for life (INCOME) from audited, licensed institutions

- Capital growth (preferably dividend reinvestment to put the power of compounding on your side)

- Optional attention to long term care funding

- Optional attention to leaving a larger legacy

- Close attention to reducing fees, reducing risk, and working to reduce taxes

Meet Steve

Have a no-cost, no obligation conversation with an experienced adviser and fiduciary.

Steve only accepts 6 to 12 new clients per month in order to serve each with optimal attention and personal service.

Free Retirement Readiness Review

To arrange your free review, please contact(480)902-3333, or email: [email protected]

Don’t just manage your money, master your money®

If you feel like you are currently drifting or that you can’t clearly articulate what your current investment strategy is and where it’s heading, it is probably time for a fresh look at a strategy that is clear, math based, and systematic.

Rather than throwing your money into one big pot and hoping for the best, we work to make sure that each of your dollars has a specific task and time deadline.

If you never run out of income, you’ll never run out of money. But if you run out of money, how will you create income? Let’s make sure you never run out of income.

Ready for the next step?

Plan, Invest, Insure, Retire and Stay Retired.

How do you feel about your current investments? Will they take you where you want to go?

If you don’t feel in control, or feel like you are drifting, we can help.

Get A Free Financial Check Up

If you’re not feeling totally fine with your investments–and if you’ve read this far that’s probably the case–then it is quite possible that your investments are not allocated properly for your risk tolerance and time horizon.

Face it–You are no longer the same investor you were ten or twenty years ago. Your needs have changed. Your risk tolerance has changed. Your outlook for the future has changed. And your need for safety and income have changed. If your portfolio looks about the same as it always has, you could be heading for a rude awakening. Let’s fix that.

Explore the IQ Wealth Safer Bucketing™ Retirement System

©Copyright 2014-2019 by IQ Wealth Management.

Note:

Investment securities and annuities are on opposite ends of the financial spectrum. We believe both can contribute to a well balanced retirement portfolio. Each has its own benefits and limitations. Therefore, we maintain two divisions: securities and insurance. Fee based investment advisory services are provided by IQ Wealth Advisory, LLC, a Registered Investment Adviser. Insurance and annuities are provided by IQ Wealth Management–Insurance Division. Annuities are insurance-based financial vehicles designed not for growth but for income preservation and sustainability. Annuities are not FDIC insured and may have surrender charges for a period of time. Generally, a partial withdrawal of 5 to 10 percent is allowed annually, penalty free. The annuities we recommend waive all surrender charges upon death. All guarantees rely on the financial strength and claims-paying ability of the issuing insurer. At IQ Wealth, our policy is to require at least 100 years of successful track records and strong ratings for any insurance company we recommend.

Income riders are a means to enhance the income benefits provided by the underlying annuity contract. A discussion regarding whether an annuity would meet your needs and objectives should take place, before deciding if an income rider is appropriate.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of IQ Wealth Management and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Fee based financial planning and investment advisory services are offered by IQ Wealth Advisory, LLC a Registered Investment Adviser in the state of Arizona. Our firm also utilizes third party SEC registered investment managers when we believe it will benefit our clients.

Referring professionals (accountants and attorneys) are not employees or direct affiliates of IQ Wealth, however, typically they provide special pricing for our clients and listeners. Murray Titterington is an Investment Adviser Representative of IQ Wealth Advisory, LLC. IQ Wealth employees and principals do not render tax or legal advice. Referrals are provided as a courtesy to help our clients with their due diligence. No investment is required.

Insurance products and services are a separately licensed activity offered through IQ Wealth Management. Steven Jurich is the founding principal and licensee of both companies. IQ Wealth Management is a registered DBA tradename for both licenses with the Department of Insurance and the Securities Division of the Arizona Corporation Commission. The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Arizona or where otherwise legally permitted. All references to locations outside of Arizona and all references to guarantees on income or death benefit relate to insurance services only. Guarantees rely on the claims paying ability of the insurer. Steve Jurich is a licensed life insurance and annuity agent authorized in multiple states, including Arizona (resident) and California (License 0b85609). Licensing in itself does not infer a level of skill. Because our portfolios often allocate a combination of securities and insurance based products, understand and inquire about the differences between investment securities and insurance products. Thank you.