2022 is an interesting year to say the least. With inflation being reported at a 40-year high, many people wonder—”hey—should I buy inflation protected treasury “I” bonds, known as TIPS?” Should YOU?

To get a nice interest rate for a while on a $10,000 investment for extra pocket money and to fill your gas tank, sure why not? To build and preserve wealth? No. I’ll explain.

What is an I Bond?

A Series ‘I’ (Inflation) savings bond is a security that earns interest based on both a fixed rate and a rate that is set twice a year based on inflation. The bond earns interest until it reaches 30 years or you cash it, whichever comes first.

First, the facts. Here’s what you need to know about TIPS.

These bonds are purchased directly from the U.S. Treasury. The interest gets adjusted every 6 months and there is a five year holding period. If you cash out before the five year anniversary, there is a penalty. The maximum amount of an I bond that can be purchased per individual (tracked by your social security number ) is $10,000 electronic, and $5,000 paper.

There is no way to own larger sums of I Bonds. What about I Bond ETFs? Yes, you can buy them, but shockingly, I Bond ETFs are losing money Year To Date. Keep reading.

I-Bonds–the actual bonds themselves—are indeed sporting a high yield, adjusting to inflation. The current yield is 9.62%.

The yield will be adjusted in October of 2022.

Here’s the problem: If you want to buy $100,000 worth of TIPS Bonds or $1,000,000–you can’t do it. TIPS are bought directly from the Treasury. The limit to buy them directly is $10,000.

Per the U.S. Treasury website:

KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made. For example, if you buy an I bond on July 1, 2022, the 9.62% would be applied through December 31, 2022. Interest is compounded semi-annually.

REMEMBER! You can only purchase up to $10,000 in I bonds each calendar year. If you buy I Bonds exceeding that limit, we will process a refund, which may take up to 16 weeks.

How much in I-bonds can I buy for myself?

In a calendar year, you can acquire:

- up to $10,000 in electronic I bonds in TreasuryDirect

- up to $5,000 in paper I bonds using your federal income tax refund

Three points:

- The limits apply separately, meaning you could acquire up to $15,000 in I bonds in a calendar year

- Bonds you buy for yourself and bonds you receive as gifts or via transfers count toward the limit. Two exceptions:

- If a bond is transferred to you due to the death of the original owner, the amount doesn’t count toward your limit

- If you own a paper bond issued before 2008, you can convert it to an electronic bond in your account in TreasuryDirect regardless of the amount of the bond. (The annual limit before 2008 was greater than today’s limit of $10,000.)

- The limits are applied per Social Security Number of the first person named as owner of a bond or, for an entity, per Employer Identification Number

U.S. Treasury Website Explaining I Bond Purchasing

Can I buy I bonds as gifts for others?

Yes.

Electronic bonds: You can buy them as gifts for any TreasuryDirect account holder, including children.

Paper bonds: You can request bonds in the names of others and then, once the bonds are mailed to you, give the bonds as gifts.

Buying I-Bonds as gifts for little kids may be a fine application. Just remember, there is a five year penalty period if anyone wants to cash out.

How much in I bonds can I buy as gifts?

The purchase amount of a gift bond counts toward the annual limit of the recipient, not the giver. So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.

Can any person buy an I Bond?

| Individuals | Yes, if you have a Social Security Number and meet any one of these three conditions: United States citizen, whether you live in the U.S. or abroadUnited States residentCivilian employee of the United States, no matter where you live To buy and own an electronic I bond, you must first establish a TreasuryDirect account. |

| Children under 18 | Yes, if they meet one of the conditions above for individuals. Information concerning electronic and paper bonds: Electronic bonds in TreasuryDirect. A child may not open a TreasuryDirect account, buy securities in TreasuryDirect, or conduct other transactions in TreasuryDirect. A parent or other adult custodian may open for the child a TreasuryDirect account that is linked to the adult’s TreasuryDirect account. The parent or other adult custodian can buy securities and conduct other transactions for the child, and other adults can buy savings bonds for the child as gifts.Paper bonds. Adults can buy bonds in the name of a child. |

| Trust, estate, corporation, partnership and some other entities | Electronic bonds (in TreasuryDirect): Yes Paper bonds: Trusts and estates: In some cases, YesCorporations, partnerships, other entities: No |

So, What About ETFs and Mutual Funds Built Around I Bonds—Can I Put More Than $10,000 Into Them?

Yes, you can, but here’s the problem: believe it or not, you can lose money in I Bond ETFs and Funds.

Any time you are buying an individual bond, you will get the stated yield (coupon rate) if you hold it to maturity. However, when you buy a fund or ETF based on the bonds you think you want to own, you will not ever hold bonds to maturity. The ETF or mutual fund constantly is buying, selling, and trading the bonds inside the fund.

When you buy a bond ETF, you immediately leave the primary direct market and enter the secondary market. Your value every day will be determined by the resale (resale, not retail) value of the bonds within. If the secondary market doesn’t want the bonds in the fund, your value goes down.

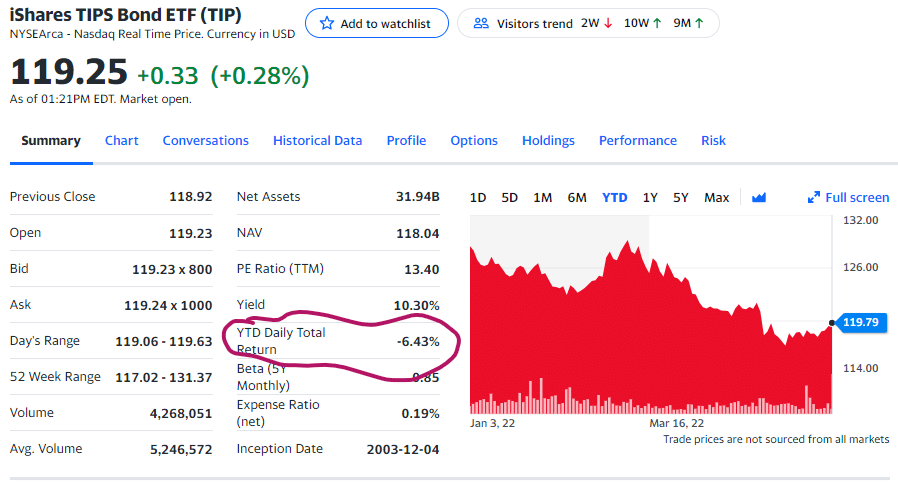

As of May 27th, 2022, here is the year to date return on the most popular I Bond ETF:

Source: Yahoo.com

Yes, you are reading it right: The I Bond ETF is down 6.43% year to date.

Down? How can that be? The yield is over 10%! Yes, but the market is comprised of professional bond traders, and guess what–they don’t want those bonds in your ETF. They have already sold for a profit and are awaiting the next batch.

If it sounds a bit complicated, it is.

If you are looking for a simple, one size fits all solution in an I-Bond ETF, look elsewhere.

Just because inflation is high and rising doesn’t mean that a TIPS fund will be making money. It can easily be the opposite. Often what matters more is what is expected to happen with inflation in the months, quarters and years ahead. Like everything else in the market, the expert large investors are thinking six and nine months ahead, while amateur investors still are stuck in last week.

“This is an area where it looks simple, and obvious: why not just buy them if inflation is going up?” says Eric Jacobson, fixed income strategist in Morningstar’s manager research group. “The answer is that the market had anticipated everything you are seeing.” In other words, when you are buying, they are selling. Another way of saying that—they are selling when you are buying and happy that you showed up.

This is still one of the worst times in history to own bond funds and bond ETFs

Is it blowing your mind to see an inflation protected bond investment go DOWN when inflation is going UP? It shouldn’t. Bond funds and ETFS almost always lose unless interest rates on the street are going DOWN.

When rates are going UP and sideways, prepare to LOSE money in your bond funds—even funds holding Inflation Protected treasurys.

Here’s the technical explanation from Morningstar:

Currently, while inflation readings have been getting hotter, big expert investors are also expecting the Federal Reserve to take more aggressive action to put out the fire. So they are selling OFF the current batch of TIPS to willing and unvitiated amateur investors.

As Jacobson said “With TIPS selling off, the market isn’t reacting to the inflation news, it’s reacting to expectations of actions by the Fed,” says Jacobson.

Bond Funds Can Lose Money Because You Do Not Own Any Bonds. You own the STREET VALUE of the bonds inside the fund.

Bond traders TRADE for a living. In an ETF or bond, you aren’t buying the yield like you think you are. You are buying the TOTAL RETURN, meaning the daily trading price of the bonds, not just the yield. If you have a yield of 10.3% and a loss of 6%, the value of the bonds within have lost 16.3%.

This dynamic is playing out in negative returns on TIPS funds so far in 2022. I would not recommend TIPS etfs or TIPS mutual funds.

Instead, consider getting smart about inflation and realizing that a carefully selected NEXT GENERATION retirement annuity, with a Guaranteed Lifetime Withdrawal Benefit (GLWB) can provide exceptional protection against future inflation, when utilized in an annuity ladder system. I help my clients with annuity ladders every day.

The annuities I recommend and guide my clients with do NOT lose money to the market. Fact: No annuity I recommend has lost a penny to the market this year, or any year, and many of them are growing future income @ 7% annually, guaranteed.

This can result in a lifetime income of from 5 percent to nine percent for life or more. Why own a bond fund that can lose money and pay poor unreliable income? Why not instead own a proven asset making far more than any TIPS ETF or fund.

In addition, a better way to take on inflation in the future is with a high quality dividend growth portfolio. The Black Diamond Dividend™ Growth portfolio from IQ Wealth, is the best in my view.

There are no bonds in the Black Diamond™ portfolio. This is intentional because the investment environment for bonds right now is not good.

With dividend yields in the range of 3% to 5% from investment grade companies, the Black Diamond Dividend portfolio has a higher yield than treasury or corporate bonds, AND the dividends RISE every year.

Portfolio Rule: Every stock must raise its dividend every year or it is eliminated, no exceptions, no excuses.

Any company that doesn’t raise its dividend is gone. As an investor in the Black Diamond, you are getting paid great dividends every ninety days. When you are reinvesting those dividends into a declining market, you are buying more shares at lower prices.

Steve Jurich is an Accredited Investment Fiduciary®, investment manager, and chief advisor with IQ Wealth Management® in Scottsdale, Arizona. IQ Wealth specializes in fiduciary based financial planning for retirement. The Scottsdale investment management firm offers exceptional dividend investments and advanced planning with top ranked annuities, which can be used for 401k rollovers.