Here’s the deal: There are vast differences between annuity payouts when compared with the more than 1200 available. Both Fidelity and Vanguard rank in the middle of the pack. For your retirement, why not the best?

We all want the most for our money and that is certainly true when you make the prudent decision to anchor your financial plan for retirement with an annuity. Unfortunately, most people aren’t aware that the best annuities cannot be found at big box brokerages like Fidelity and Vanguard.

Being the second largest financial brokerage in the world with $7.1 trillion dollars in assets, it’s natural to think that every possible financial asset you could WANT may be found at Vanguard, or the other big popular brokerage, Fidelity. It’s important for you to know that is simply not the case. The annuity offerings at Fidelity and Vanguard are quite limited in scope, in fact. This comes as a surprise in this “Amazon” world of one-stop shopping.

Consumer Alert: You should compare in earnest before committing to a Vanguard or Fidelity annuity. The income can be thousands of dollars less per year.

Why You Must Compare Before You Commit

It’s understandable to assume that no comparison is needed. After all, Vanguard is ROYALTY when it comes to mutual funds. It’s what they do. Same with Fidelity. Mutual funds are their bread and butter. But annuities are merely a sideline for them, sold strictly on the Fidelity or Vanguard name, and the assumption that what is true for mutual funds is somehow true for annuities. Not so.

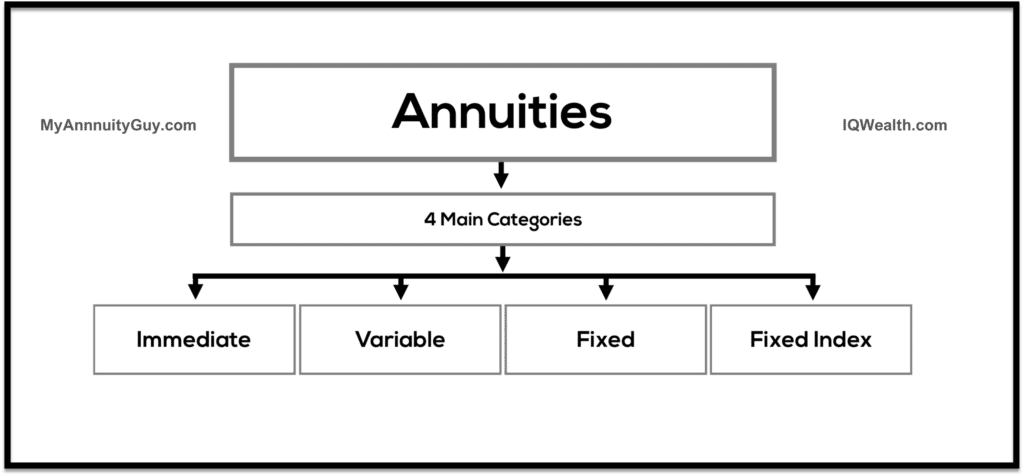

There Are 4 Kinds Of Annuities–Know The Difference.

Consumer Alert: Be on guard for what they call “Fixed Income Annuities” offered At Fidelity. “Fixed income” is a common term used in mutual funds, where it means something totally different. With a fixed income mutual fund, your principal still belongs to YOU. With a so called “fixed income” annuity at Fidelity, you sacrifice all access to your money permanently. Fidelity’s “fixed income” annuities are merely immediate annuities and your principal is generally completely drained to nothing in 10 to 12 years. If you would rather maintain ownership of your principal and potentially “earn” some strong interest, do not choose an immediate annuity. Do not choose a so called “Fixed Income” annuity, unless you look under the hood. Typically a Next Generation Fixed index annuity will give you all the income you need, but with protection for heirs. Why disinherit your heirs? With the right annuity, you don’t have to.

Many advisors are not supportive of the decision to solidify your portfolio with a high quality annuity. They’re ready to keep your money totally at risk and hope for the best.

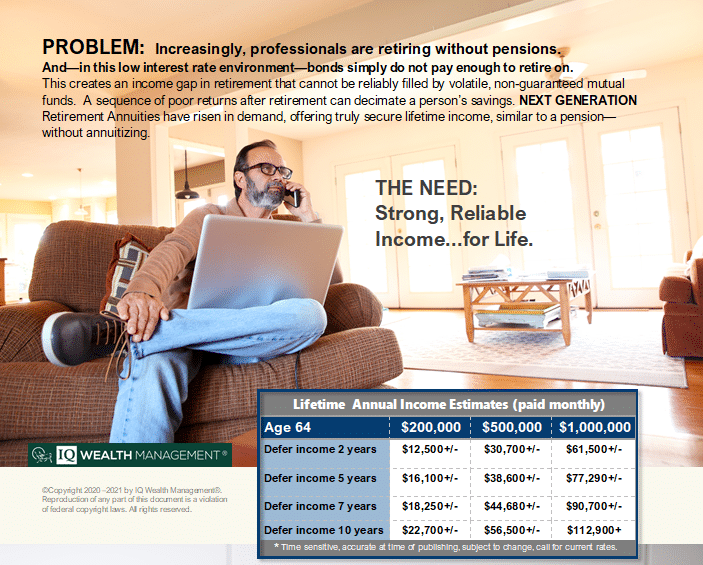

A prudent portion of your money can be in the market, but let’s say you don’t want to perpetuate the risk in retirement with unpredictable mutual funds. Instead, you’re looking to preserve your capital and double your retirement income with a high quality, highly-ranked annuity. Where do you look?

Certainly NOT Vanguard or Fidelity. Annuities are simply NOT what they do. It’s a sideline, nothing else. The facts reveal their annuities rank among the lowest yielding, least innovative in the industry. I’m not afraid to say it because it’s so easy to prove.

The sad truth is that big brokerages may apparently sell annuities only to make a sale. It seems that way to me, because they do not compare the top ten or twenty annuities in the country and make sure you own only the best. Who does that?

The factual data clearly show that Fidelity and Vanguard annuities do not rank highly for income and protection for heirs.

Neither Vanguard nor Fidelity are insurance companies. They do not own insurance companies. Basically, they act as an agent of a few life insurance companies–offering only a smattering of what is available to a more demanding consumer. Clients sometimes buy annuities there, but strictly on the Vanguard or Fidelity name– not on the basis of actual income rank, protection of principal, or protection for heirs.

Customer service is also an issue. The person you talk to today at Vanguard or Fidelity, will likely not be the person helping you next year. We often see a “tag-team” approach at the big box brokerage houses.

You’ll need to look elsewhere if you want the most for your money, and I assume you do.

The most advanced annuities today are the genuine article. They are a sophisticated product of mathematical and actuarial engineering, catering to the desires of demanding consumers who want to retire with exceptional income for life, very low fees, principal protection and uncapped upside growth potential.

These annuities are being chosen by affluent, preservation minded investors who want the top of the heap, not the middle of the road.

As a financial advisor, investment manager, and Certified Annuity Specialist®, I can tell you that you’re losing money and leaving money on the table if you are shopping for annuities at Vanguard or Fidelity. I don’t fear saying that because I can prove it in less than five minutes.

FACT: The annuities of old are a thing of the past. But the annuities of the past are what you find at Vanguard and Fidelity. Here’s an example: While Vanguard takes pride in having some of the lowest fees in the world for mutual funds, their variable annuities are actually fairly pricey—there’s typically a 1.6% annual fee. Do you get safety of principal for that fee? No. Do you get industry-leading, top ranked guaranteed income for the fee? No. A fee is not a bad thing if you are gaining an essential benefit. Adults don’t expect something for nothing.

Compared to the top ten Next Generation Fixed Index annuities on the market, Vanguard and Fidelity simply cannot compete in the most important areas: protection against all market losses, very high income for life, low fees, and protection for heirs.

Worse yet, the employees at the Big Box brokerages often herd investors into immediate annuities, wherein you lose all access to your principal for life, with very low interest and the reality that you will run out of money completely in ten to twelve years. True, your income can continue, but if you could have comparable income yet keep control over your principal, wouldn’t that be a better choice?

SUMMARY:

Before you commit principal for an annuity at Vanguard or Fidelity, get a second opinion from a Certified Annuity Specialist® and Accredited Investment Fiduciary® with a background in annuities. Don’t buy any annuity from a person who believes it is unimportant to compare. You’ve come this far by being picky and selective about where your money goes. The right annuity can change your life for the better and help you retire with calm and confidence.