What if you never had to worry about another market crash as long as you live, while at the same time having more guaranteed income than you’ll ever need? Might that change the way you see your future? Might you worry a little less?

Managing money in the wild and wooly 2020s should not be taken lightly. A strategy built for 1995 will not work in 2021. In 1995, you were much younger. You were contributing to your retirement plan, not contemplating withdrawing from it. When you retire, you say goodbye to your bi-weekly paydays forever. You are forced to start creating your own paydays, from that point forward. Although you have some money saved for your retirement, you are technically unemployed for the next thirty years or more.

Therefore, with all that could go wrong economically, politically, health-wise, and tax-wise, does it make sense to stay with an unprotected approach, hoping for the best? Does it make sense to lock in your fixed income, or do you feel better winging it?

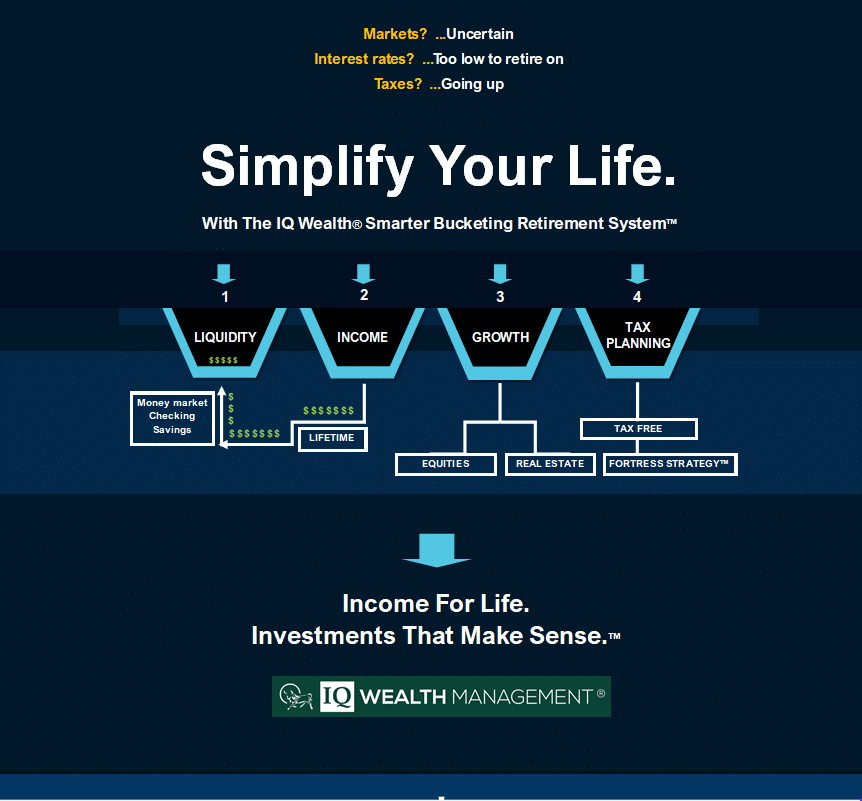

We all know that hope is not a strategy, but you may not know that worry does not need to be your hobby in retirement. Financial bucketing is the answer. Rather than putting all your eggs in one basket, you build a firewall between your income assets and your growth assets.

Presenting the IQ Wealth Smarter Bucketing Retirement System™

When the core of your nest egg is protected against market loss 24/7/365 and your income is guaranteed as long as you live—you can stop worrying about this mature bull market suddenly turning into a bear. When you’re 30 or 40, invest like you’re 30 or 40. But when you are 50,670, or 70, its time to stop investing like you are 30.

We start by separating your fixed income capital from your growth capital. At that point, you are taking a major FIRST STEP in insulating yourself from the next major crash. You can’t drown in the ocean if your home is built on a strong dry concrete foundation ten miles from the shore!

So, step number one in constructing an intelligent financial plan for retirement is to ESTABLISH the amount of money in dollars that you never want to lose. Ever. One simple and proven way is known as the Rule of 100. You simply subtract your age from the number one hundred. The remainder number is the maximum percent of your overall savings that you should consider risking in the market—IF preservation is one of your goals.

And, If preservation IS one of your goals, this is something you want to take seriously. Here are the steps: Step One: Decide HOW MUCH of your money you want safe and secure: some of it, none of it, half of it, or all of it? There’s nothing wrong with admitting you don’t want to lose money anymore. Your plan should precisely reflect your risk tolerance and time horizon.

Then, Step TWO is to choose assets that will protect your money, yet still grow it, an still provide income to live on. Bank accounts and money markets are safe and liquid, but they don’t pay enough to live on. Mutual funds have upside potential, but they aren’t safe. So, it is a good idea to identify in writing which assets in this world are not affected negatively by down markets?

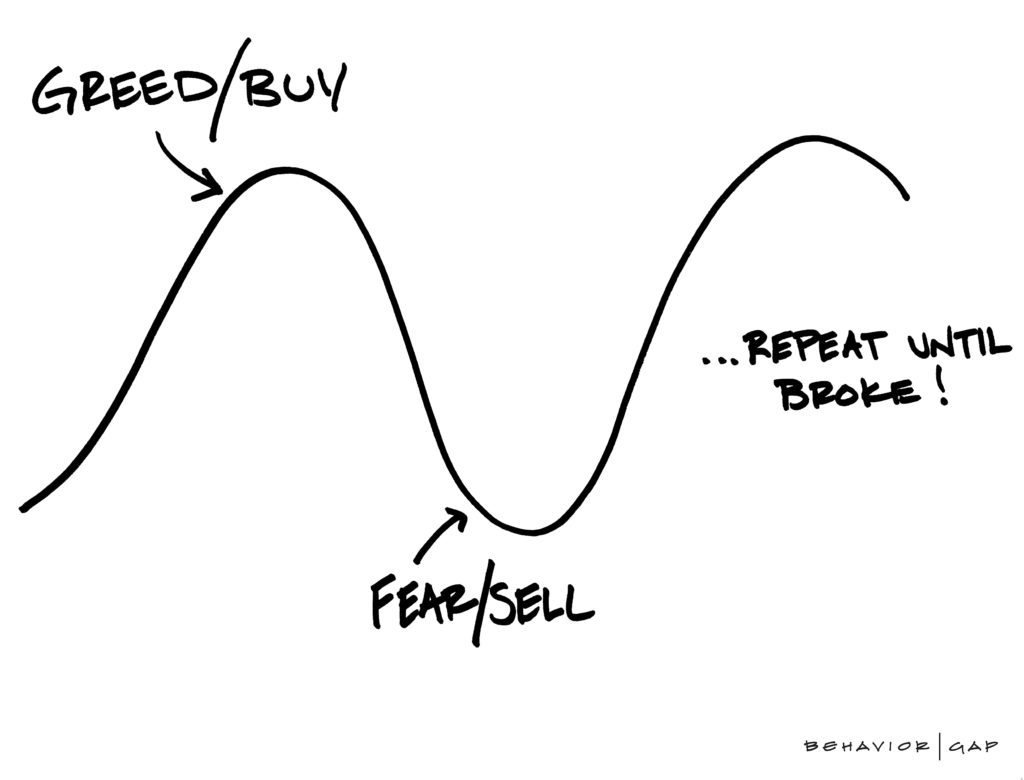

Breaking The Fear/Greed Cycle–with Financial Buckets

Achieving financial goals begins by defining them. If you want to grow your money systematically and never have a worry about income hitting your bank account every month from now on, guaranteed, you need a strategy change. In short, you need to break the Fear/Greed Cycle. The above cartoon is kind of funny because it strikes a chord. But it is actually pretty serious if you find yourself repeating yourself, every ten years. Growth is nice in retirement and we all like to see our brokerage accounts rise. But what’s the plan when the market finally reverses? You may not be thinking about fixed income in a big way, but fixed income–and the safety it provides–is necessary in retirement. If you don’t need income now, chances are you’ll need it later. If inflation becomes the factor you worry about, the antidote is a source of lasting, reliable income you can tap into on demand.

Where To Find Secure Fixed Income That Never Goes Away

In your search, you’ll find there are really only three reliable sources of viable, proven assets that carry no market risk: bank instruments, government bond instruments held to maturity, and insurance instruments like annuities. Among annuities, you’ll want to stay away from variable and immediate annuities. Too many fees with variables, complete loss of control of principal with immediates. In my view, not the optimal choices.

Step 3: Building A Plan Based On Logic, Common Sense, and Math, Not Just Markets.

Relying on market outcomes to take you where you hope to go for the next 30 years is a “hope-so” plan, not a “know-so” plan. Wouldn’t you rather be certain about where you are headed? There are many outcomes that could befall you in the years ahead. What do you say we focus on the better outcomes and make them happen? With our help, you can arrive at your desired destination on time with money in your pockets.

Stop Listening to Annuity Critics: Uncapped Next Generation Retirement Annuities are built for the 2020s and Beyond

The ten year treasury is yielding less than two percent. Imagine tying up a million dollars to get less than $20,000 a year of income. The right annuity can deliver $20,000 to $40,000 annually for life, using only $400,000.

IN the past, annuities were frowned upon. Today, they have been revamped and re-engineered. Suddenly bonds and bond funds are the non-starters for thinking people who can do simple math.

To keep your money safe, out of harm’s way, protected from market risk, and paying you enough income to live on for the rest of your life, you may find yourself parked squarely in front of annuities. Sorry, Ken Fisher. Annuities are insurance-based instruments but are not life insurance. They can guarantee that you never run out of income as long as you live and can guarantee that your income will never diminish.

Billionaires like Ken don’t need that kind of assurance. They have enough money for five lifetimes. But you don’t.

The annuities of old are a thing of the past.

Today’s NEXT GENERATION of uncapped, low cost, high income, principal secure index annuities are finding their way into the financial plans of retiring engineers, teachers, pilots, attorneys, dentists, accountants and business owners. Why? Safety, security and lifetime income—which will come in pretty handy in the years ahead.

They can be a very suitable fit for your Fixed Income Bucket, providing four or five times the income of U.S. Treasury bonds with a very high degree of safety. We recommend only audited, regulated insurance providers with A+ ratings and can help you compare. As a full service financial firm, we can also help you with smarter choices for your Growth Bucket. That would include the IQ Wealth Black Diamond Dividend™ and the Blue Diamond Technology Leaders™ portfolios.

Enjoy the fun, challenging, interesting, and long retirement you’ve worked so hard for–with the IQ Wealth Smarter Bucketing Retirement System™

Steve Jurich (pronounced Jur-itch) is a Kiplinger® Contributor, an Accredited Investment Fiduciary®, and a Certified Annuity Specialist®, independently representing multiple carriers. Asset custodian: Fidelity®. His radio show MASTERING MONEY can be heard Monday through Friday on AM1510 in Phoenix. Podcasts here

Investment advisory services by IQ Wealth Management, a registered investment advisor. No specific tax, legal, or investment advice is being given. Annuity guarantees rely on the financial strength of the issuing insurer. Compare annuities with a qualified financial advisor and fiduciary.