Over the past century, markets have crashed A DOZEN TIMES, several times by more than fifty percent, leaving investor’s dreams in disarray for YEARS. Not only is money lost, but TIME is lost. It takes time to build up a nest egg. The last thing anyone wants is to start over in retirement.

If you’ve been saving for thirty years for your dream retirement, it makes no sense to go back to where you were ten or fifteen years ago with your capital. Can it happen? Well, of course it DID happen–twice–in –2000 and 2008. With the stock market, we know it’s not a matter of IF, but simply WHEN it falls. It’s part of life. But it shouldn’t impact YOUR LIFE in retirement.

Markets recover eventually because Americans keep contributing to their 401ks.

Demand drives price in the market, and 401ks drive demand. Right now, with all the political turmoil and uncertainty, you may the fear that a crash will come along and ruin your retirement. That can happen only if you have too much money at risk and invested in the wrong assets. When you were thirty you could swing for the fences. But if you’re in or near retirement, a hefty portion of your money should be kept completely out of harm’s way.

The Real Secret To A Secure Retirement

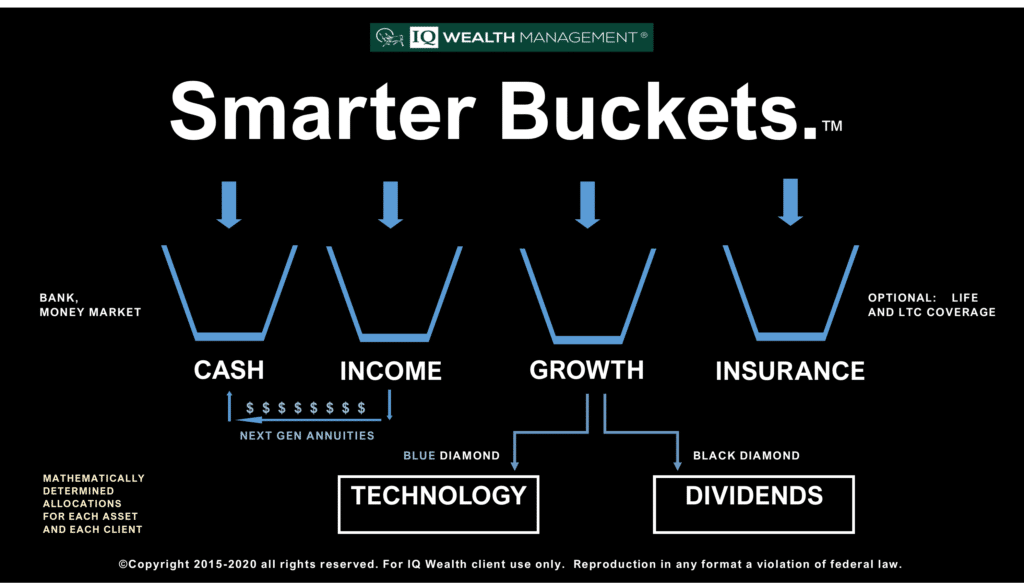

At IQ Wealth, we believe smarter planning is the key to a more trouble-free retirement. Our unique process, Smarter Bucketing™ helps our clients simplify and clarify their finances. Bucket planning is a common-sense system of allocating money according to its purpose. When each dollar in your portfolio has a job to do–and a timeline for getting it done–your financial plan is more clear and realistic. Combining preservation, income, liquidity, and growth in a solid plan: That’s how to plan YOUR retirement like you mean it.

You need a cash and liquidity bucket, a preservation and income bucket, a growth bucket, and an optional insurance bucket. The first step for any retirement strategy is to make sure you have all of the income you and your spouse need for both your lifetimes, even if the market crashed by fifty percent.

Rather than stressing over your rate of return 24/7, take steps to insure your income 24/7/365 and for the rest of your life. Try as you might, you have no control over the markets and the rate of return you will actually end up getting. Who can know that information? Nobody.

You’ll never control your rate of return in the market, but you CAN control your income.

You can’t control the market, however, you CAN control your income. By utilizing the benefits of principal-secure, uncapped Next Generation retirement income annuity, it is possible to simply “select” the income you want to receive for life. That may sound too good to be true, but it is not. Insurance companies have been offering annuities for decades with an exceptional record of successful payment. That is due in no small part to the exacting regulation and auditing of insurance companies offering annuities. Insurance companies that are licensed in all 50 states, have 50 auditors making sure they can make good on promises and guarantees.

The way to fail in retirement is to rely on income sources that are unreliable. Many retirees make the mistake of relying on unreliable mutual funds for income. Mutual funds offer no guarantees. They fluctuate in value daily. The real problem: they can fluctuate wildly downward when recession arrives and all of a sudden– the markets crash. Is that a logical way to manage your income for life? You will likely see two to four more major crashes in your lifetime. It doesn’t mean you should avoid stocks, it means that you should get serious about separating your income capital from your growth capital.

Retirement Rule #1-A: Bad markets should never affect your income in retirement.

The reason we separate and segregate your money in a Smarter Bucketing™ plan is so that you can relax and know that your income stream is guaranteed for life, even if the market crashes by 80 percent.

We make sure our clients’ income is always safe and secure and in the range of five to nine percent, depending on age and deferral period. We build you a financial plan that works in all financial climates– rain or shine. Your risk tolerance, time horizon, and goals drive the plan. Nothing is more important to an ethical financial planner than the safety and security of their clients’ money. The objective of an ethical and effective financial planner should be the client’s peace of mind. That can can only come from knowing the client’s income capital is safe, reliable, and everlasting. At IQ Wealth, this is an ethic we build our practice around.