The year 2020…by all accounts… will go down as one of the craziest and most stress-filled years of all time. That said, many people are faced with the act of retiring this year, either by choice or by pink slip. So, here’s the question: Is this a good time to retire, or is it one of the worst years in HISTORY to retire? Let’s explore.

Does A Market Crash Have You Worried?

When you stop and think about it, your money as a whole should be giving you a warm sense of comfort and satisfaction.

If you are not feeling calm about your money, something is wrong. Here’s why and it makes perfect sense: when you are invested properly, you never need to go a day worrying about how all of this turmoil will turn out. Not because you are naïve or a positive thinker, but because you have a mathematical plan in place. Your plan has your core capital out of harm’s way in the right amount. And, most important, your plan includes defined income guarantees.

But if all you own is a mixed bag of stocks, ETFs and mutual funds with none of it guaranteed—and you’re not pleased with the performance you’ve been getting for the past five years, you probably know subconsciously that it is time for a change. Retirement should not be spent worrying. If you’re stressed about your money, you’ve likely reached the proverbial fork in the road. Your next step is simple: You can stay with the risk and lack of clarity you own now, or you can make a smart change. How? Easy. Simply resolve to get more of your money to safety, preservation, and income before the next crash comes along. Do it now. You’ll feel better. You can always go back to risk if you really want to.

Listen to that little voice

Think about it. What if you freeze and don’t make a change right now when the market is high enough to do some harvesting? Let’s say an economic downturn comes along…where will you be then? You’ll be a little older, a little slower to react, and have even less time to recover. Sometimes that little voice you are hearing to make a change– is right on the money.

Here’s the deal. If you find that your money is causing you stress, and you lack a deep sense of security, something is wrong with the way you are allocating your money.

How do you personally define security?

Does it mean you own a diversified portfolio of large cap, mid cap, small cap, international and emerging stocks along with some bond funds? Seriously? Many people—many advisors—try to call that diversification. In fact, if that’s what your portfolio looks like, you aren’t diversified at all. You may own a lot of different things, but what is the science behind those choices? And do they match your personal risk tolerance? In the industry, we refer to this oversimplified mish-mash of asset classes as a “cookie-cutter” portfolio. In reality, you aren’t truly diversified. You have everything in one place… on Wall Street. The next time Wall Street gets slammed, you may feel across the board pain. Everything you have could go down because these asset classes have lost their “negative correlation.” If you study the charts you will see that all popular mutual fund asset classes go up and down almost almost in unison.

Diversification doesn’t just mean “variety”. Diversification means owning truly different types of assets that are capable of protecting you against the bad while keeping you in position for the good. You need both protection and performance at any stage of your life. Can a bond fund do or emerging market fund do that? Of course not. Simply put, you need to own assets that “zig” when others “zag”. Solid retirement strategies also include assets that are immovable objects. Assets that act like lighthouses in a storm. Most of your money should be safe in retirement. Security is not external. It is not a badge you wear on your chest or a description of the mutual funds you own. It is an inner feeling of confidence based on the knowledge that you have solid portfolio that will meet your cash flow needs on a guaranteed basis years into the future, with no “goof ups.”

The key to smart money placement is being true to yourself.

Security means your income is strong and your debts are under control. Even if a share of your investments carry some smart, calculated risk, most of your money is safe and out of harm’s way. In other words, a market crash will not interrupt your lifestyle one bit.

We all enjoy making good money on our investments. We all would prefer relative calm and steadily climbing markets forever — with no abrupt surprises. But that’s living in a dream world.

Like it or not, we happen to be living at one of the most volatile times in history, with uncertain economic forces at work, and very poor returns on most safe assets. For example, previous generations of retirees were not faced with interest rates on bonds this low.

When our parents retired and even as recently as the 1990s, interest rates on bonds were five, six, and seven percent. A retired couple could actually live completely off bond interest and social security with no money in the market at all. Think about it: When your safe income in retirement from all sources exceeds all of your expenses for a lifetime, investing in the market is kind of optional. You can choose to be in the market, or not. Rulebooks written 30 years ago—when bond rates were five times higher than today– should probably not dictate your decisions in the 2020s and beyond. If you really want that deep down feeling of satisfaction and calm about your money, then allocate your money to income and preservation first. After that, you can invest the rest with purpose. You’ll be happier.

And although we believe this market will recover as the COVID 19 Virus abates, we must also face the fact that the future that is no longer as certain as it once WAS. The bailouts are resulting in massive debt, and we have a government on both sides of the aisle still promising to take care of a growing population that does not save enough.

Will Social Security and Medicare will hold up? These aren’t investment problems, these are PLANNING problems.

Your financial plan for retirement should include contingent, back up streams of cash flow–in case Social Security bombs out. Why stress out about it? Isn’t it more proactive to insert income solutions into your plan?

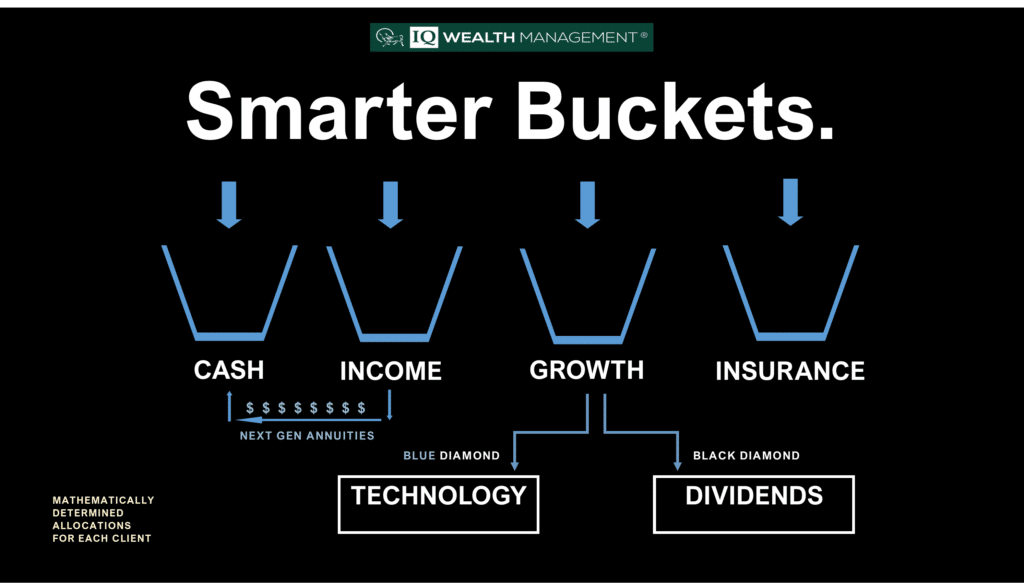

The bottom line: you can no longer afford to manage your money the same old way you have been, if all you own are mutual funds, stocks, and ETFs. The smart portfolios of the future will be allocated, separated, and bucketed by purpose. Each dollar in the portfolio should be given a job to do. You must be precise, not wasteful, and not cling to a cookie cutter approach playing by outdated rules. You need a bucket for instant safe liquidity, one for lifetime guaranteed income, and one for equity growth. That’s how you avoid a crash, yet still grow your capital.

We’re talking about a financial bucketing system that addresses each important job you need your money to do and giving it a time deadline—in writing—for getting it done. With a smarter bucketing system, you first analyze the problems, then measure the challenges. You then meet those challenges head-on with effective solutions, and build a structure that is ready for the worst that life can throw your way.

You need a liquid cash bucket, an income and preservation bucket –UNAFFECTED by poor markets–and a growth bucket that can take advantage of market opportunities. We like Next Generation Annuities in the income and preservation bucket. We like dividend and technology stocks in the growth bucket, and like our clients to keep enough in liquid money market cash for emergencies, fun, and lifestyle..

Right now is an excellent time to take a breath, sit down, and review your strategy. It is a good time to get a second opinion on what you’re doing to see if there are concrete ways to upgrade your income, increase your overall safety, lower your fees, and feel better about everything you own.

And, Because fewer people are retiring with pensions, the demand for annuities is growing. The lower that interest rates fall and the shakier markets get, the more attractive annuities get. Why wouldn’t you want some guaranteed outcomes in your future? Why wouldn’t you diversify with a heavy duty financial instrument that will not go down when the market falls? And, why not investigate your options in the area of guaranteed income, uncapped growth potential, with no market losses, ever?

With today’s high-income, principal secure uncapped Next Generation Retirement Annuities, you get ample liquidity and flexibility. You can share in the upside of market indexes without a cap, and never take a loss when the market falls. You and your spouse may enjoy a lifetime income yield of five to nine percent for life, depending on age and deferral period. I’m happy to get together with you and talk about it.

Tune in Mastering Money with Accredited Investment Fiduciary® Steve Jurich, Monday through Friday at 8am and 11am on Money Radio. AM1510, 105.3FM. Podcasts here