The unfortunate truth about variable annuities is that they have given the industry a “black eye” allowing annuity critics and “haters” (like Ken Fisher) to state that all annuities have “high fees.” This is false. Of the four main categories of annuities, only variable annuities deduct costs directly from your principal. Immediate, fixed, and fixed index annuities have zero fee deductions for management and administration.

The right kind of annuity isn’t just a GOOD fit for retiring professionals, it can be a GREAT fit. In fact, many of my clients would use the words “indispensable” and “irreplaceable” to describe their retirement annuities and the function they perform within their financial plans. There simply does not exist any other financial vehicle which can replicate the guarantees and steady amounts of lifetime income and security of principal that a carefully selected and properly matched annuity can deliver–on time and under budget. And, it can do all of the above with zero annual fee deductions.

Variable annuities are a blend of higher risk investment with contractual income guarantees. The income guarantees are typically equivalent to the income that can be received from bonds, but rather than the income being in the 2% range, the income can be in the 5% to 9% range, depending on age and deferral period (in the case of Next Generation fixed index annuities.)

Annuities should not be lumped together, no more than people or cars should be lumped together. True, a Toyota Prius, a Honda Accord, a Hummer, and a BMW X5 are all cars, but they do their thing in dramatically different ways. There are annuities, by the way that function more like a Prius, more like an Accord, more like a Hummer, and more like an X5. It all depends on what you need and what you are looking for.

Cars are not all bad or all good, and neither are annuities. In my practice, I generally reject over 98% of all annuities on the market and generally do not recommend variable annuities ever–why pay a fee to risk your money and watch your principal go up and down on a daily basis. Annuities, in my view, should be all about income, preservation, predictability, low cost, and simplicity. (Yes, I said that annuities can be made simple once you understand the basics.) To keep your original principal safe, your fees low forever, and your income high for a lifetime, variable annuities should not be first on your list of options. They also should not be used for accumulation vehicles because of the high fees. I do offer a few variable annuities with lower costs but no income rider. They can make sense outside of an IRA to save on taxes during accumulation.

Here’s when variable annuities seem okay: Variable annuities do fine during long bull markets when the owner is not withdrawing for income. You don’t notice the fees if your balance is rising. A rising balance is always pleasing to the eye and the emotions. The negative side of variable annuities becomes very apparent when suddenly the market goes flat or downward for several years and the owner begins to withdraw for income. That’s when you will see the major impact of the high fee structure and how the fees will be charged on your higher benefit values (not kidding!).

While fixed, fixed index, and immediate annuities have zero fee deductions for management and servicing– and very few moving parts– the opposite is true with variable annuities. Variable annuities are built with MANY moving parts and remarkably high fees. They were invented during a time when fees were not so highly considered.

The demand for variable annuities has been falling as the newer forms of more secure fixed index annuities without caps have entered the marketplace. Variable annuities are built with mutual funds that have no downside protection. When the market is falling, a variable annuity is subject to principal depletion—both from the market pushing down the value of the mutual funds, and the steady fees coming out of the mutual funds– of up to four percent annually!

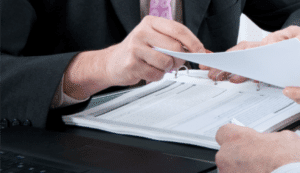

A $300,000 variable annuity may have fees of over $12,000 a year, every year you own the annuity! Over a period of ten years, the fees alone could total a hundred and twenty thousand dollars–deducted straight from your principal. Over twenty years, the owner of a variable annuity that started out at $300,000 dollars, could shell out over a quarter of a million dollars in fees.

Those fees include what is known as the mortality and expense fee, an admin fee, and fees for riders added to the annuity to guarantee lifetime income. By contrast, a principal protected uncapped Next Generation fixed index annuity would have zero annual management fees because there are no mutual funds to worry about. The owner of the Next Generation index annuity may also choose a model that has a zero fee rider, meaning that zero deductions from principal of any kind would be taken as long as the owner lives.

Almost every aspect of a variable annuity has a fee associated. In an age of no load mutual funds and consumer awareness about excessive fees, it is surprising that variable annuities were so popular in years past. Today, consumers understand that every dollar you don’t give to the insurance company stays in your account and can derive interest and future income benefits.

Variable annuity complexity is driven by the fact that your money is directly invested and placed at risk in the stock market. No other form of annuity does that. Even fixed index annuities linked to stock market growth do NOT invest your money directly in the stock market. Only variable annuities do. Variable contracts are unique in that they offer a pre-selected group of mutual fund subaccounts into which the investor will allocate the premiums paid. Problem #1: you pay a fee on those sub-accounts for the rest of your life, typically in the range of 1%. The values of the funds rise and fall with the markets with no guarantee of principal. Most variable products also contain living and death benefit insurance riders that guarantee either a minimum account value at death, or a stream of income for life.

These are actually valuable guarantees in an era of uncertain markets and economies, when retirees could be blindsided by devastating markets while needing to withdraw from their investments to maintain lifestyle and pay living expenses.

The good news is that income guarantees can be had with Fixed Index, Fixed, and Immediate annuities–without the risk and heavy fees.

Newer versions of Next Generation Fixed Index annuities offer all of the income with none of the downside, and a share of the upside of a market index. If you are reviewing annuities, make sure your get the facts on all four types of annuities. For a video mini course on annuities, try Annuity University.

As I mentioned earlier, variable annuities give our industry a bad name in my view. Because they charge so many fees, they can be a turn off. If that is the only type of annuity you explore, I couldn’t blame you for being turned off. But don’t hurt yourself by closing your mind on the idea altogether.

It is undeniably true that many variable annuities have total fees of 4% annually (ugh!). This would include charges like the Mortality and Expense Fee (which can be as high as 1.5%), the Income Rider Fee (which may also be as high as 1.5%) and the sub-account management fees as mentioned above, which generally total about 1%. Grand total: 4%. How does that translate? On a $500,000 variable annuity, your fees could be as high as $15,000 a year, every year for the rest of your life! In ten years, you may shell out $150,000 in fees, deducted directly from your principal. In 20 years, your fees could total more than a quarter of a million dollars. (Not kidding–it is simple math and it is right in the prospectus if you know where to look.

Is there a low cost, low risk solution? Yes. The Next Generation low cost, high income principal protected retirement annuity, with uncapped index strategies. Your fee can be zero to 1%, with very strong income and fewer moving parts.

You buy an annuity for income and preservation in my view. Why pay a fee if you don’t have to? The right Next Generation index annuity can share in market upside without a cap, and pay you a lifetime income of five to nine percent, safe and secure, depending on age and deferral period, but with no market losses. If you have a variable annuity and would like to explore exchanging it for a safer uncapped index annuity, I can help you review your options.

Steve Jurich is an Accredited Investment Fiduciary®, Kiplinger® contributor, and the host of Mastering Money–a radio show dedicated to retiring, and staying retired. Podcasts here.