It’s only natural–the speed at which you process information– and your capacity to solve problems of logic–gradually diminishes with age.

It doesn’t mean that you are old or over the hill at 65, 70, or 75. But it does mean the time may be right to pause for reflection about your current allocations.

While it may sound obvious, trimming risk as time goes on makes sense. It turns out to be one of those things we “should” do, but don’t do. In my practice, I meet many people who are still taking the same risks–with most of their money–as they did when they were 40 or 45 years old.

If you’re over 60, you’d love to go back to 45, I get it, but you must face facts. You are who you are, and you have goals. Those goals include A) protecting the money you’ve already made, B) growing your money wherever possible, and C) enjoying fixed secure income in excess of your living and lifestyle expenses.

Here’s the deal: When it comes to the management of your money and you hit age 55 or 60: You are leaving—or have left—the Accumulation Phase of your financial life. It’s quite okay—it happens to everyone.

It’s You Against The Stock Market—If You Continue To Stay Overweight In Stocks

Look, no one is saying you should abandon stocks. Far from it.

But the day comes when wisdom and smarts should overtake impulsive desires. The day comes when you are wise to take a hard look at two components of a well-designed plan for retirement. That would be A) the allocation and B) the location of your bundle of assets.

Your “big picture goals” should always outweigh your impulsive desire to crush the market as you move along in or toward retirement.

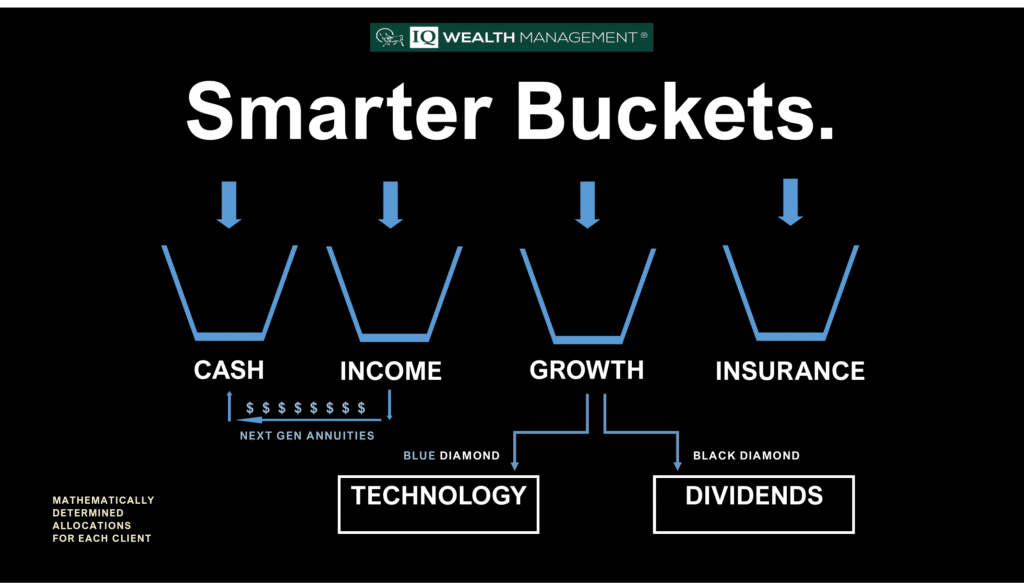

So, how much of your money should be allocated to riskier growth investments? How much of your money should be allocated to fixed income? And, how much of your money should be allocated to pure liquid cash and savings?

When you have the answer to those questions properly diagnosed, you are ready to make the move from a cookie-cutter pie chart of stocks to a brilliantly designed “bucketing” strategy, which uses math and metrics to locate the proper amount of money into each bucket.

Creating a perfect retirement is not about crushing the stock market.

Your relationships—especially with a spouse—are far more important. Almost all stock investors thought they had the world by the tail in 2007. Then came 2008. Can it happen again one day? Of course.

Growing your money prudently is a worthwhile goal. But so is protecting what you make. Does it make sense to do both with all the assets you have left in the world? Of course it does.

This is the key reason we focus on risk reduction, income protection, and solid growth in balanced portions at our firm, IQ Wealth® Management.

Life Pulls Us In Many Directions—Planning Is The Answer.

We believe our first job in helping a client retire–and stay retired—is to get a handle on competing priorities.

Life pulls us all in many directions, good and bad. Many financial opportunities sound terrific. And, a few of them may actually be viable, lol. But if we chase every rainbow, we end up going nowhere.

Life pulls us all in many directions, good and bad. Many financial opportunities sound terrific. And, a few of them may actually be viable, lol. But if we chase every rainbow, we end up going nowhere.

Fact: 80% of Men Die Married, 80% of Women Die Single.

We all know women live longer than men, so its only logical if you are a man with a younger wife, think about what life will be like for your bride of many years, after you are gone.

Regardless of which spouse is younger, developing a plan to take on the future head on makes sense at this point in your life.

I have seen it in real life. A widow or widower comes into our office to make sure they are going to be okay. They’re not doing well.

I have seen it in real life. A widow or widower comes into our office to make sure they are going to be okay. They’re not doing well.

You may be an investment wiz…today. But “Father Time” is undefeated.

And, if your spouse outlives you by five to fifteen years, how skilled will shebe when it comes to managing investments? And what about you? Will you be as sharp at 85 or 90 as you are today?

Planning for a high income in retirement with lower risk is easier than most people think. All it takes is to be honest with yourself and make a conscious change in your thoughts about investing.

The Smart Way To Offset Market Risk In Retirement

Markets go up and down. They always have and they always will. When the market is rising every day, you get blinded to the risk. The reality is that the higher a market goes without logic supporting the rise, the more risk you are taking.

The smart way to offset that risk is to dedicate a bigger portion of your assets to safe, secure fixed income guaranteed for life with no market risk.

It has always proven to be good money management to keep at least forty percent of your money in the form of permanent, safe fixed income.

Time For An “Allocation Tune Up?”

Cars and retirements both need tune ups from time to time. Changing your oil before a breakdown is a no-brainer.

Tuning up your allocations is also a no-brainer. Trimming risk and planning for more income can only make you stronger. Risk is easy to ignore when your stocks are going up, which is why it is always best to solve problems before they present themselves.

So, maybe it’s time to do a checkup on yourself.

Are you ignoring a blind spot?

Let’s check your mirrors.

Upon examination, you may find you are taking more risk than you thought, more risk than you should, and most important–more risk than you need.