Most people have a primary source for their investment advice and ideas, whether it’s a friend, a relative, a newspaper or online columnist, a stockbroker, an advisor or a planner. But, I believe, too many people are far too casual about where they turn to for advice. Many investors have no clear idea what type of advisor they have—or should have.

If you have a medical condition that needs attention, you choose a practitioner carefully. You wouldn’t hire a heart surgeon to take care of an eye infection; and you wouldn’t rely on a pediatrician to take care of your aging parents. This is so obvious, it’s almost funny. But millions of investors make fuzzy decisions like that when they choose a professional whose area of expertise is no longer a true fit for their CURRENT personal situation.

Moving away from a financial advisor is not always easy. If you’re someone who values relationships, and most of us do, you may find yourself hanging onto a relationship with a financial advisor because you simply don’t like change. Who does? Plus, you don’t want to hurt their feelings. Maybe family’s involved.

Drifting without a plan

But face it, your investments aren’t doing so well. Something is holding you back and you may feel like your money is just drifting, with no plan.

Here’s the problem. You’re no longer the same investor you were ten or twenty years ago. Your goals have changed. Your risk tolerance has changed. Your outlook for the future has changed. And your need for safety and income have changed. It’s time to admit it, and move forward.

If your portfolio looks about the same as it did ten or twenty years ago, it’s likely time for a change. You shouldn’t feel guilty or ashamed that you want your money to do more for you. Your advisor may be a skilled accumulation specialist, but may have limited (or no) expertise in creating secure retirement income plans that guarantee your money will last. This isn’t a knock on your current advisor, but it may be a fact.

3 Major financial phases in your life

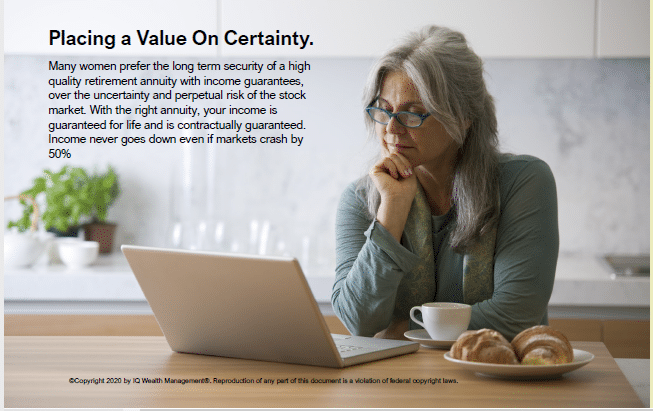

There are three major phases in your financial life: The Accumulation Phase, The Preservation Phase, and the Decumulation (or, spend down) phase. Many people make the mistake of remaining purely in accumulation assets–like mutual funds—as they enter retirement. This can result in serious shortfalls later in life due to market risk, and is the reason why many people feel they cannot retire on a million dollars anymore.

Think about it. In the Accumulation phase of your life, you were bringing home a regular paycheck, contributing steadily, and BUYING on the dips. In the de-cumulation phase after you retire, you are SELLING on the dips if you stay in the wrong investments with too much of your money. This can cause a problem known as negative compounding.

Can you still retire on a million dollars?

It can lead to a premature drawdown of your retirement assets…. AT PRECISELY the wrong time in your life—and your spouse’s. Imagine if you have a million dollars at retirement, you start withdrawing forty thousand dollars a year to live the life you’ve planned and dreamed about for thirty years. Then, as markets do, the market happens to crash by the following year, falling by 50 percent. Before you know it, your million is cut in half and you are drawing almost ten percent of your money annually to live on, with thirty years to go, or longer.

That is the perfect picture of a failed retirement income plan and it happens more often than you think. In fact, smart people realize this series of events can be a reality, which is why they wonder if a million dollars is enough to retire on anymore.

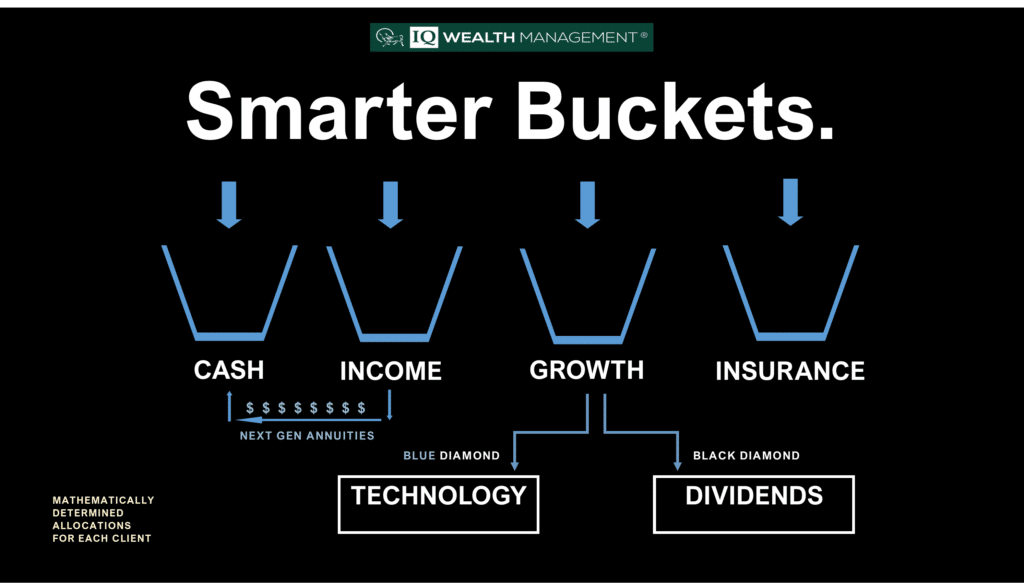

What’s the answer? How can you comfortably retire on a million dollars (or even less)? It’s called Smarter Financial Bucketing, which we specialize in at IQ Wealth Management. Our proven planning method puts a firewall between your income assets and your growth assets. It preserves all-important liquidity for all emergencies and lifestyle needs.

Master your money with Smarter Financial Bucketing

Our simple but secure planning approach works to insure your income, insure your outcomes and invests the balance of your money with clearly defined purpose. We aim to lower your risk and lower your fees. Our goal is to give you the confidence to look the future straight in the eye—and like what you see.

We look forward to meeting you and seeing how we may be of service to you.