It really breaks my heart when people don’t plan ahead. Why? Because it’s so easy to do. You don’t fix your roof when it’s raining, you do it when the sun is shining. You’ve worked twenty, thirty, or forty years to be where you are now. How will you make sure your money lasts another thirty or forty? By planning. Americans have worked hard their whole life, got up every morning, and provided for their families. They’ve contributed to the growth of this nation through their effort. Congratulations. You were part of making this country great. Now it’s time to keep making it great by making your retirement a success.

The Way It Used To Be

Because of the kind of work you did and the time you put in, you’ve truly earned retirement. But retirement is not all sunshine and lollipops. Without a plan for all that could go wrong, it’s hard to make things go right. It’s sad that many people don’t plan for market downturns with easy, logical shifts in their allocations. Instead, they end up getting hit hard with unexpected and prolonged market crashes that inevitably come their way.

Wouldn’t it be cool if we didn’t have to plan for recessions, inflation, or market crashes?

If only the market would cooperate and just keep going up from now on. Our bank accounts would just keep swelling and stress would be out the window. But we all know that’s not how it is. For the rest of your life and mine, governments will overspend, markets will overbuy, and things eventually run into the ditch.

Which brings us to what a successful financial plan for retirement is all about. It isn’t just how much money you HAVE, it’s really about how much money you have coming in– and how reliable that income is. Wouldn’t it be nice if everyone had a pension that kicked in when they retired? But the truth is that fewer and fewer people don’t have a pension, and even the ones that do, need more income for retirement to feel really secure.

That said, many people do have an IRA, 401k, 403b, or TSP plan of six or seven figures. It provided a way to grow their personal wealth by contributing part of every paycheck for thirty years or more. These are all great options for getting to retirement. They are not always best for getting through retirement.

Having discipline matters

If you have a solid amount saved in your retirement plan, It warms my heart to hear this, because it means that I’m talking to someone who knows how to stick with discipline, and has planned ahead. Your discipline got you to retirement just fine. The next challenge, I know you’ll agree, is getting THROUGH retirement.

Now, there are two types of financial plans:

“Hope So” plans vs. “Know So” plans: Which do you have?

A “hope so” plan would be one that is optimistic at the core, and still carries an unreasonable or inappropriate amount of risk based on a person’s current stage of life. The risks are either accepted or ignored. It may be optimistic, but is it realistic?

A “know so” plan is one that instead, confronts the problem head-on and seeks to solve it. It realizes that the stock market, although filled with opportunity, also carries a great deal of risk. For a person of thirty-five, a correction of 40% or 50% is an opportunity. “Throw more money in” would be my advice.

But for a person of 55 or 65 drawing income from their investments, a crash of forty or fifty percent is a disaster. Yes, markets come back, but they won’t always snap back like the Covid 19 recovery. During your thirty or forty years of retirement, you may experience three or four “whoppers”—category 5 hurricanes. They don’t come back so fast.

Hope for the best, plan for the worst

More bear markets are coming. Therefore, it’s my belief—shared by a growing number of retiring engineers, teachers, physicians, business owners, tech workers and health care workers—that it is wise to reduce your risk at retirement.

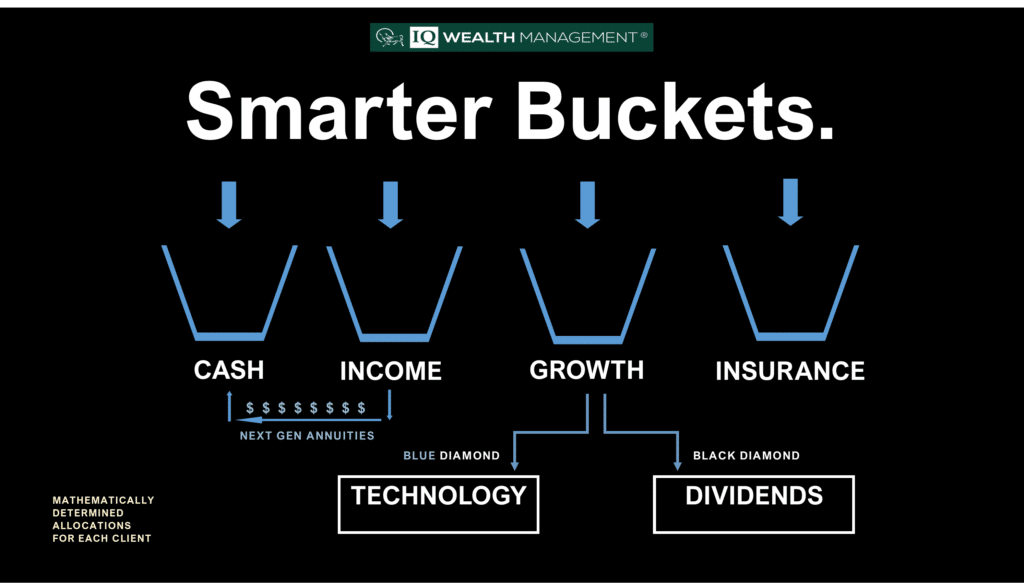

It’s fine to keep money in the market inside your “growth bucket”, but it’s even smarter to section off and dedicate a big part of your life savings toward income and preservation. Let the storms come—your retirement is still intact. Remember this important planning detail: the day you retire is the day you leave the accumulation phase of your life, and enter the preservation phase. Those who missed this idea when they retired in 1999 or 2007 paid a dear price.

Allocate your money into smart financial buckets: make planning simple

So, if it is not the wisest idea to keep all our money at risk in retirement, where can we put money to keep it safe, keep a lasting income rolling in, and protect our heirs?

The answer, once upon a time, was government bonds. They once paid 7%. A million dollars in treasury bonds once yielded $70,000 a year. Today, the yield is less than one percent. A million in treasury bonds today yields more like $7,000! No one wants to tie up money at rates so low. Now you know why logical people are turning to annuities. Every year, more than $200 Billion in annuities are acquired. Annuities are issued by state regulated, state audited life insurance companies with an excellent safety record.

So, if you find yourself considering annuities, you are being logical. That said, getting overwhelmed by poor information can happen easily. Type in the word annuity into google, and there are more than 300,000 pages to explore. Wow. How does a person consume and digest that much information? Especially when the decision on where to place the money–that must last the rest of your days– is so important.

Let’s do a quick overview to help you eliminate hours of searching. It’s very important to understand there are 4 very distinct categories of annuities and they aren’t all created equal, nor do they behave the same in up and down markets. Selecting the wrong type of annuity is where you can go awry. With over 1200 annuities on the market today, and hundreds of agents in your area, its hard to jump right in and feel confident.

After all, we’re talking about one of the most important financial decision of your life, involving the protection of everything you’ve worked for. So…yeah. It’s not something you want to guess on. Getting the right annuity can change your life and make your retirement. Imagine a secure IRA ROLLOVER that combines the power of a pension, yet allows you to grow your money without market losses. Your principal is protected against loss 24/7 yet you are able to share in upward gains of a select market index–without a cap.

Stop losing money, never run out of income

A quiet revolution has occurred in the world of financial planning for retirement over the past five years. It is now possible to ensure against loss, while getting an nice share of the gains. You go up with your money, never down, forward never back, staying in control of your principal always—the insurance company does NOT keep your money when you die. Here’s the thing…when things are going well, we don’t like to ruin our day by planning for a rainy day. But just like with health issues, it is smart to insure against financial loss, especially when it costs virtually nothing .

When crazy market events come along, we learn how vulnerable we really are. Having a floor under your money in retirement is not only smart, it is now NECESSARY. Now is the perfect time to make your move to safety, preservation, income, and upside potential without the risk of market loss.

The world is getting crazier and you aren’t getting younger.

Get some guarantees for you and your spouse that won’t get blown away in the next crash. The first step in building a plan to withstand the 2020’s is to build a firewall between the RISK you are taking in the market– and the money you can’t afford to lose under any circumstances. Many investors unfortunately throw all their money into one big pot of non-guaranteed, flimsy mutual funds. When a crash comes, they’re devastated.

A better strategy is to dedicate a share of your funds from your portfolio to a high quality NEXT GENERATION lifetime retirement annuity that won’t lock up your money, yet will pay you much more income using fewer dollars than any bond —In fact you can own a lifetime income for two people of from five to nine percent depending on age and deferral period.

Some investors tend to ride stocks up, then ride stocks down—then retire, only to find themselves withdrawing steady income from a declining balance.

This leads to a very poor, worry-ridden retirement. Instead, why not plan to have more money coming in than you can spend—without worrying if you will run out?

With more than 25 years experience, our unique system compares annuities on five key factors. The result: we reject more than 98% of all annuities on the market today. Fewer than two percent of annuities make my recommendation list. I rank annuities based on rate of income, lowest fees, index growth potential, special features like long term care, protection for heirs, and company ratings with AM Best and Standard & Poors.

Did you know you can get solid annuity information without talking to a high pressure sales person? You can. We invite you to experience an educational process to determine: a) if an annuity is a good idea for you b) which annuity would be the best fit. We want to help make sure you understand what you’re getting from an annuity, how to avoid “locking up” your money with the wrong one, and how to gain the confidence that you and your spouse will be able to retire, and stay retired.

(C)Copyright 2020 by IQ Wealth Management. Reproduction in any format is a violation of federal copyright law and strictly prohibited.