Knowing what you can control in this world–and what you can’t–is the first step in planning your successful retirement. Financially speaking, once you give up your paychecks from work there is a simple phrase you’ve heard often that must become your mantra: “Hope for the best, but plan for the worst.” Following that advice is not being pessimistic, it is being realistic. Your financial plan for retirement should be as heavy on protection and preservation as it is on seeking growth.

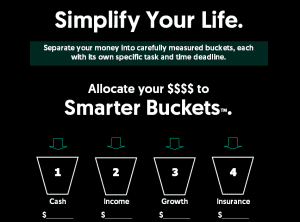

Bucket planning is a common-sense system of allocating money according to its purpose. When each dollar in your portfolio has a job to do–and a specific timeline for getting it done–your financial plan is more clear and realistic.

In this very volatile time, you need a financial plan that works in all financial climates– rain or shine—up or down. You want a plan designed to keep your retirement income far ahead of your expenses—with a built-in surplus, not a deficit. The government can operate at a deficit (for now), but you can’t!

Your risk tolerance, time horizon, and goals MUST drive the plan. At our firm, IQ Wealth Management, plans are built assuming that everything we’d like to go right–like markets and the economy–will go wrong. This is the same type of thinking that has built the pyramids, the castles of Europe that are still standing, century-old sky scrapers, Hoover Dam, and custom built homes that look the same as they did fifty years ago.

The IQ Wealth Smarter Bucketing System aims to simplify your plan for building, growing, and protecting your retirement money.

Rather than a haphazard, traditional pie-chart approach—where you are crossing your fingers hoping for the best, Smarter Bucketing™ brings order, discipline, and control into your life. It is designed to protect you from the worst that the economy and markets can bring. In fact, it is designed to benefit from market declines in several important ways.

The secret to financial bucketing is the separation of large problems into smaller, manageable tasks. Smarter Bucketing™ separates your savings into clear, FUNCTIONAL, and distinct buckets. Most important, it establishes a firewall between your income assets and your growth assets, giving every dollar in your portfolio a specific task and time deadline—laid out in a written plan.

We live in a complicated, constantly changing world. Algorithms are running the stock market. The Trade War and the Fed are wild cards. Bonds pay too little to live on. Politics is a mess. And we are learning that Social Security in its current form may not always exist for those with higher “means.”

It’s time to get serious about allocating money for the NEXT twenty years, rather than remaining stuck in the same tired strategy of the PAST twenty years. Bucketing your money in retirement is one proven way to help you insure your income, insure your outcomes, and invest the rest with purpose.®

At our firm, nothing is more important to us than the safety and security of your income, the prudent growth of your money, and building a close, friendly relationship for the years ahead.

Steve Jurich is an Accredited Investment Fiduciary®, a Kiplinger contributor, and host of the popular daily radio show MASTERING MONEY in Phoenix. The show is available 24/7 via podcast at RetirementRadioUSA.com