It’s hard to blame investors for trying to save on fees and expenses when they invest their hard earned money. After all, most of us have a natural desire to save money on just about everything we do. We were raised that way—a penny saved is still a penny earned. In fact, we still raise our kids and nag our spouses that way.

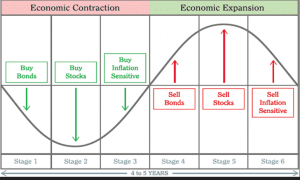

Therefore, no-load mutual funds and index ETFs sound like sensible places for our money. The long term growth charts and average annual returns of around eight or nine percent are in line with our objectives and goals. These mutual funds and ETFs have very low expenses and can be excellent tools when used in the proper way, for the proper purpose, in the right amounts, and at the right time of your life.

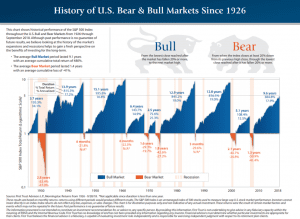

Some investments are fine for 35 year old’s, but not so much for 55 or 65 year old’s. In the long run, the market index works out fine—as long as you have twenty years to let the average play out. For example, the market averaged over 18% from 1989 to 1999. What a thrill! But from 2000 to 2009, the market showed a ten year loss. What a bummer!

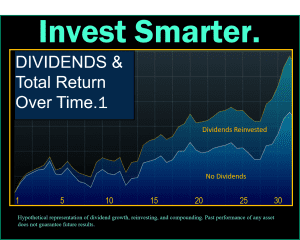

In reality, it was simply a reflection of the way the market works. The long term average for the S & P 500 is around 7% without dividends reinvested and about 9.45% with dividends reinvested, according to Wall Street firm Ned Davis Research and numerous Standard & Poors charts. The reality? What goes up, does come down, and over twenty year and thirty year periods, “water seeks its own level.”

The difference maker is whether or not you choose to use the proven tool of reinvesting dividends. Reinvesting the dividends of quality companies is a tool in your tool box that may serve to lower your overall risk and increase your overall long term total return.

Most important, we need to be careful to use the right tool for the right job when investing. The best chain saw in the world is not recommended for peeling potatoes. A scalpel is a precision tool that can help perform miracles in the right hands. But you and I would have very little use for one. Case in point: some tools are excellent, but only if they are used by skilled professionals. And if we’re not careful, we can really mess things up.

For example, if you are in or near retirement, no-load mutual funds and ETFs could be wise for part of your portfolio as a long term holding where you can let the average actually play out. Otherwise, if you are in or near retirement, too much can go wrong without warning. Index funds can be up twenty five percent in a year, but they can also be down twenty five percent. Consider that fifteen years of stock market growth was lost in just fifteen days of stock market losses during 2008. You may have the right tool, but be using it at the wrong time.

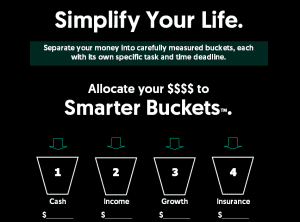

Retirement investing is far more difficult than general investing. Once you are closer to age sixty for than thirty four, mistakes are far more costly. The do-it-yourself approach could truly cost you a fortune. Financial bucketing is an approach to retirement planning that can help you simplify, protect, and get your money working toward your personal goals.

The right bucketing plan can also keep you from getting hurt by the market at exactly the wrong time in your life.

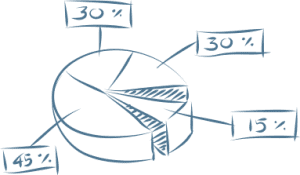

I recommend a four bucket system. It consists of

1) a “cash” bucket filled with bank assets and money markets for instant liquidity

2) a fixed income bucket filled with lifetime guaranteed annuities–preferably cash building, income paying annuities.

3) a growth bucket, invested in dividend growth stocks for the most part

4) an insurance bucket (optional) where you may address life insurance and long term care

With your money divided into buckets, each with its own written task and time deadline, you may find yourself far more confident about your retirement future. Throwing your money into one big pie-chart of mutual funds and hoping for the best is no way to take on the very uncertain future we face as a nation and globally. A secure and math-based financial bucketing strategy may be worth looking into and comparing to your current plan.

Scottsdale Financial Planner Steve Jurich is an who hosts a daily radio program in Phoenix, Arizona. He is a Kiplinger Contributor with more than twenty two years of retirement planning experience. Websites: IQWealth.com, BlackDiamondDividend.com, RetirementRadioUSA.com.