2016 Was The Year Of The Value Stock, 2017 Was All About Momentum and Growth Stocks. 2018: Enter the Dragon (Jerome Powell of the Fed). 2019? The China Trade Deal and the Fed Will Determine The Market’s Fate

Many people right now have come to a mountain pass in their financial plans for retirement. They are on a fairly high perch. They can see the past from here pretty well. But the fog is rolling in, clouding the future. China, a potential recession, politics, Iran. That’s plenty of fog for anyone.

We all know the market is closer to the top than the bottom, interest rates on bonds are near zero, and in retirement, we cannot afford to go backwards. In retirement you need reliable streams of recurring passive income that require no work, no talent, no timing, no guessing, come rain or shine.

You also need a sensible way to GROW money—even in retirement—preferably in a separate financial bucket. So, what is the smartest thing you can do with your money right now? Keep swinging for the fences? Settle for a cookie-cutter portfolio from a big name brokerage with high fees and high risk? Keep your money in bond funds and target dates at the lowest interest rates in a hundred years, waiting for markets to fall and interest rates to rise—which could kill your bond funds? Come on! YOU deserve better.

The markets could keep rising for a while. But what is your strategy for when stocks inevitably fall? Clients of IQ Wealth Management are in a solid and strategic position for the next fall and all subsequent recoveries. Through the power of compounding and dollar cost averaging, the objective with the Black Diamond Dividend Growth portfolio is to keep accumulating more and more shares for our clients with a professional, mathematical, and disciplined approach to investment management.

Ironically, the Black Diamond may tend to create more market wealth for the future DURING market pullbacks and declines than during upticks. Why? WE require increasing dividends from every stock in our portfolio every year, no exceptions—even if the share price is falling. Every stock in our portfolio RAISED its dividend in 2008 and 2009. When stock PRICES are falling, the companies keep making profits in the real world. Your increasing dividends keep buying more shares inside your account. You win, even when the market is losing because of increased accumulation. When markets inevitably recover, you will do so with ownership of more shares.

The companies we own are workhorses of the real economy. They are dominant –Big companies with investment grade credit ratings. But if any one of them fails to raise its dividend, it is gone. Our clients expect quality and we always aim to deliver.

When markets decline, your steadily increasing dividends keep on buying more shares of quality companies at lower prices automatically. THAT’S SMARTER INVESTING.

Rather than floating with the market, get SERIOUS with the Black Diamond Dividend Strategy. NOW is an excellent time to get started.

Dividend Investors Always Are Getting Paid To Own Their Investments. Dividend GROWTH Investors Get Paid, AND Get A Raise Every Year.

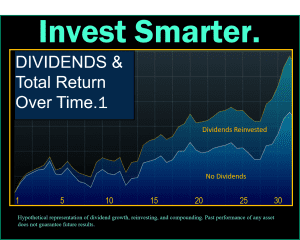

Most investors focus on price appreciation of stocks while others focus on dividends. Dividend investors have a better track record overall, according to many researchers like Ned Davis Research.

History has shown that the bulk of the stock market’s returns are delivered by dividends – reinvested and compounded, which is why we pay special attention to dividend history. By requiring a minimum of ten consecutive years or more of increasing dividends along with an investment grade credit rating and other factors, we can focus on profitable companies that have a niche in their industry and are making good things happen.

Only consistently profitable companies can afford to keep paying dividends, so profitability is of critical importance. Dividend investors should be most interested in researching the strongest most profitable companies, that also happen to be trading at an attractive valuation.

The challenge for the smart dividend investor is to find the temporarily “unloved” solid performer paying exceptional dividends, and not paying too much of its profits in dividends. A company that goes overboard with the dividend cannot reinvest in itself. Logically, this is unsustainable.

Investing In Sustainable Trends

By finding consistently profitable, well run companies that keep paying you to own them, we believe you have an advantage over the hit-an-miss effects of market timing.

The reinvesting of dividends, and compounding of dividends from companies with lower debt, high credit ratings, and solid business models is a path to higher probability success.

That’s the objective of the IQ Wealth Black Diamond Dividend portfolio, which by its nature is playing both offense and defense right now. We have a strong cash position to both shield our portfolio from a sudden reversal and to help keep us nimble and able to step in and buy from our Watch List.

Price appreciation is pure speculation. Dividends are money in the bank. Reinvesting Dividends Creates Geometric Growth Over Time

While there are many ways to approach success in the stock market, the most hit-or-miss method is trying to time the buy and sell of stocks, funds, and ETFs. Invariably, you will be out when you should be in, and in when you should be out. This has proven to be a way to miss the ten to twenty best days of the market over any five or ten year period. Research from Ned Davis, Morningstar and others have shown fairly conclusively that missing the ten best days in a ten year period can cut an investors return in half.

Market timers argue that they are also missing the ten worst days. In fact, the only way to do that, is to stay out of the market completely. In reality, its not a black and white situation. The market timer may only miss five of the best days of the market, but may hit three or four of the worst days in trying to miss them all. The result is mediocrity, and no compounding of gains which is the real secret to wealth in the stock market.

The IQ Wealth Black Diamond Dividend portfolio stays the course, while making adjustments to make sure that all of our stocks are yielding 3% or more, and have increased their dividends not less than ten consecutive years, meaning every stock on our portfolio increased its dividend in 2008. Many have been increasing dividends for 20 years or longer, meaning they raised their dividends during the Millenial crash from 2000-2003 AND the crash from 2008 to 2009.

Our approach, which we believe tilts the odds in favor of the investor, capitalizing on consistency and finding a way to take advantage of down markets. By reinvesting during down markets, the dividend investor accumulates continuously more shares, which in turn pay more dividends. When your dividend payers are having babies, and grow up to be adults who have babies, you have a long term growth strategy that is designed to benefit from both bull markets and bear markets. Add the spices of time and patience, let the strategy cook, and you have a higher probability recipe for the accumulation of wealth in your financial plan.

With your best interests in mind.

Best Selling Author and Kiplinger Contributor, Steve Jurich