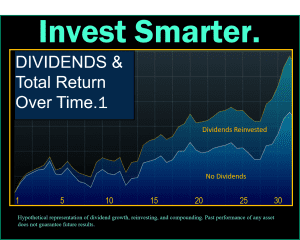

The return on a stock market investment is twofold. First is the dividend, which pays YOU, the stockholder an ongoing cash return of investment capital. The second is the growth in the price of the shares, which offers the investor the possibility of selling at a profit. Investors who ignore dividends often find it difficult to time not only the “buy” side, but the sell side of a stock.

When you invest only in non-dividend paying stocks, you only have one avenue for making a profit: selling at the right time. You can hold a non-dividend paying stock for five years, watching it reach exciting heights. But if you don’t sell it when you are feeling the most joy about the increase, you could lose fifty percent in the next crash.

Market timing is difficult. Dividend growth investors, on the other hand, keep accumulating more and more shares of the quality stock they own. There is no concern about market timing—your dividends are reinvested back into your stocks each quarter, like clockwork. You will be wisely reinvesting whether you are at the beach, golfing, or sleeping. It is automatic and systematic.

A proper dividend investment strategy selects only the caliber of companies that you want to own more of. At IQ Wealth, our standards are high. We seek companies that aim to increase their dividends by 4% to 12% annually, and show a verifiable track record of doing so. The companies we select are leaders in their sector and in their industry. Without investing a dime of extra capital, the dividends that these companies keep paying you to own them continue to buy more shares. Those new shares, in turn, also pay dividends and also buy new shares.

Dividend growth investors receive a continuous return on capital, paid directly into their accounts. When those dividends are reinvested and given time to compound, the results can be remarkable—especially when the rate of dividend increase averages in the range of 6% to 8% or more. We believe that investing in Dividend Growth Stocks–stocks with a track record for increasing dividends every single year without fail–may result in excess return over time. When markets decline, your increasing dividends buy even more shares at lower prices. You win either way. In our portfolio, if any stock fails to raise its dividend, it is removed.

While past performance is not a sure indicator of future results, simple mathematics and historical real-world evidence confirm that the reinvestment of increasing dividends over time is a strategy with upward bias. This is especially true when the selection criteria is specified and disciplined. For example, we require strict minimum dividend yields, strong earnings growth rates, investment grade credit ratings, strong leadership within the sector, and analyst consensus among other factors.

Not just “Dividend Payers”, Dividend GROWERS.

For reference, explore the information compiled by Ned Davis Research comparing Dividend Paying stocks, Dividend Growers, Non-Dividend paying stocks, and Dividend Cutters. A Dividend Grower is a stock with not only consistently growing dividends, but a record for CONSECUTIVE dividend growth, year after year.

In the period from January 31 1987 through January 31 2016:

Dividend Growers averaged a return of 13.8%

Dividend Non-Changers (no consecutive increase in dividends) averaged a 10.1% return

Dividend Non-Payers averaged a 7.4% return

Dividend Cutters averaged a 6.6% return

S & P 500 Annualized (with no dividends) average: 7.072%

S & P 500 Annualized (with dividends reinvested) average: 9.45%

Source: Ned Davis Research, Proshares

Past performance is no guarantee of future results. These statistics are provided for educational reference only, and readily available to the public at the websites of Ned Davis Research and Proshares, tracking the peformance of Dividend Aristocrats.

Best Selling Author and Kiplinger Contributor, Steve Jurich

Steve Jurich is an Accredited Investment Fiduciary®, Investment Manager, and ‘Chief Retirement Strategist with IQ Wealth Management in Scottsdale, Arizona. (480)902-3333 His daily radio show, Mastering Money, can be heard monday through friday from 8am to 9am on Money Radio in Phoenix. Podcasts can be heard 24/7 found on i Tunes, or by clicking here