In 2013 a new word was added to the Oxford English Dictionary. It is an acronym: FOMO, and it is now officially a word you can use to win a game of Scrabble.

Fear of missing out… “FOMO”… is an increasingly powerful emotion in our daily lives according to psychologists, social scientists, and yes ….INVESTMENT ANALYSTS! Have you ever heard about the stock market moving higher while your money was sitting in a money market, earning virtually nothing, and felt the pain of envy or regret? Yes? If so, you are normal. After all, that could have been YOU!

Further, has that emotion led you to dump money into a stock or ETF that is careening higher and higher, even though you haven’t done any real analysis and have no real idea where it’s heading? The ETF is up 20% since the start of the year and seems to be on a roll. You think to yourself, “that’s the one.” That, my friend, is FOMO – the fear that– at any given moment–someone is getting something that YOU are not, and you suddenly have the urge to get in the game.

We find ourselves in a go-go market that we might refer to as MOMO: Momentum on top of momentum. Many investors have turned into surfers. Riding the wave of stocks or ETFs that seem to be on a roll, for the fear of missing out. Jumping on a wave is fine if you have an exit strategy in place before you get in. If not, you may be wise to stick with long term value stocks that pay steady, growing dividends.

FOMO is a social media term. The term is usually reserved for those who spend everything they have to buy the latest gadget, phone, high tech watch, clothing, fancy car, or vacation as seen on social media. FOMO is what drives people to go into revolving credit card debt, paying in excess of 24% interest. Some say FOMO is the main reason why so many people are unhappy, even if they are living better than 99% of the world.

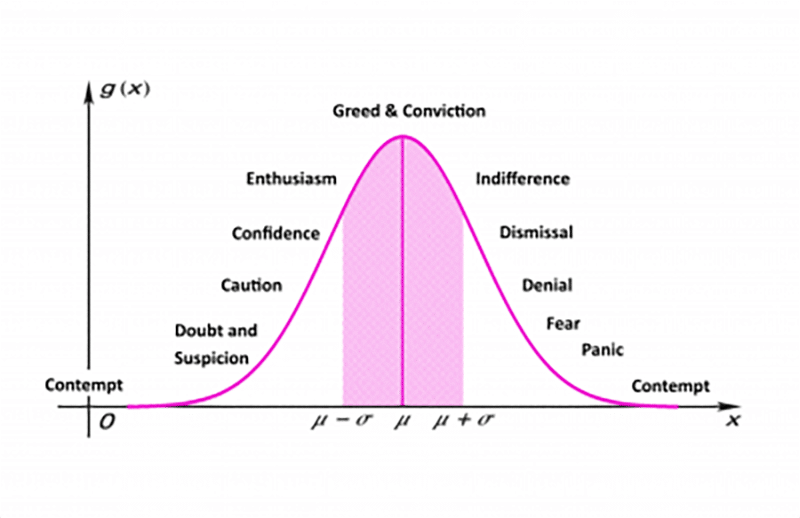

In the world of investments, FOMO is that feeling that “everybody else is getting rich, but not me…so I’d better jump in.” Most people do not seem to realize that momentum investing is like a roller coaster. There is a high point that is reached and without expecting it, there can be a sudden drop. There may be one more big hill ahead. The view is actually quite nice. You stare at the screen and like what you see. Then before you know it, the ride is over. You lose money and wonder what you were thinking.

Once you hit the peak in a market–which is nearly impossible to predict–you won’t like what comes next! After violently correcting in 2008, the S&P 500 fell even further in 2009, finally hitting bottom on March ninth of that year, completing a 57% peak-to-trough move.

Since then, with help from the Federal Reserve, the market has been on a tear, rising nearly four hundred percent. It took many investors a long time to jump back in after 2008. For the first four years, the skeptics remained on the sidelines. But when the S&P 500 and other indices started surpassing their pre-financial crisis highs in early 2013, the fear of missing out began to take hold in a big way. The market had risen over 100% from the low point.

Why didn’t more people get in sooner? Fear. It was the fear that as soon as they put their money in, the market would fall and take it again. So, they waited. Many investors waited until the market rose 200%. They finally felt like there was “confirmation.” Because of the fear of loss, followed by the fear of missing out, you can easily see why investors without a strategy who try to time the market do so poorly in the long run.

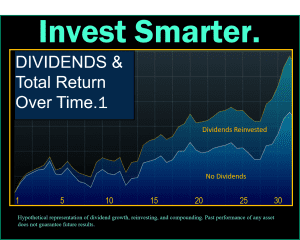

Dividend growth investors may do so much better over time because they are oblivious to the market ups and downs. They know they cannot control the market’s movements. But they can control which stocks they select. They can make their selections based on the company’s real world presence in the work-a-day world. Owning shares of profitable, established companies providing necessary goods and services is a business model that has prevailed for a hundred years.

Dividend growth investors get paid to own their investments. And they get a raise EVERY year. By owning only those stocks which increase their dividends every year without fail–and continuing to reinvest those dividends for a while– you put yourself on a collision course with compounding wealth. Mathematically, you have nowhere to go but up if you select your stocks wisely and systematically.

Down markets? They provide you a bonus. Your steadily increasing dividends continue to buy shares of quality companies at bargain prices. Once you become an experienced dividend investor, and you own only quality companies making real world profits, you may look forward to market declines. Like a golf ball scooper machine at the the driving range, your dividend “machine” keeps picking up golf balls unemotionally, adding to your growing portfolio. And remember: every new share you own starts paying you a dividend right away. It is a system that builds on itself with no work on your part.

The IQ Wealth Black Diamond Dividend strategy is a done-for-you, carefully monitored portfolio of stocks from companies that have “wide moats” and strong marketing advantages within relevant sectors. It is held at Fidelity in your own private SIPC insured account.

Retirement is supposed to be about enjoying your life and enjoying the fruits of your labor. You were a competitive person your whole life which is why you have more money than eighty five to ninety-five percent of all Americans. But once you are retired or almost there, getting crazy with your money or letting someone else’s success DRIVe YOU crazy is a way to drive yourself into poor investment results.

Your stock investments should be part of an overall plan to insure your income, insure your outcomes, and invest the rest with purpose. For more information on the Black Diamond and Blue Diamond Dividend Growth Portfolios and the IQ Wealth Smarter Bucketing system, come and see us in Scottsdale. There is no charge for a free review.

Steve Jurich, AIF® is a professional Financial Advisor located in Scottsdale, Arizona. He is an Accredited Investment Fiduciary® and a Kiplinger® contributor