Prior to retirement, investment mistakes and market losses are measured in percents rather than dollars. After retirement, that formula reverses. Retired investors stop thinking in terms of “percents” and start thinking in terms of dollars. On a million-dollar-portfolio, a year with a ten percent loss is no fun, but younger working investors may shuck it off as a simple “ten PERCENT loss”. No big deal! But retired investors who are spending rather than contributing feel like they lost a year of salary.

If you’re ten or fifteen years away from retirement, and the market declines by ten percent, you simply keep on contributing to your 401k, gathering even more shares at lower prices. It’s referred to as “buying on the dips” and dollar cost averaging, and is a proven wealth building strategy.

When Dollars Start To Matter More Than Percentage Points

Buying on the dips before you retire is fine, however, after you retire you are no longer contributing. You may now be selling on the dips rather than buying. Therefore, a ten percent loss after you retire is a big deal! In fact, a ten percent loss on a million dollar portfolio, is a hundred THOUSAND dollars. That will get anybody’s attention!

Hey, let’s face it–When you’re retired, you don’t even want to lose ten thousand dollars or a thousand–let alone fifty or a hundred thousand. You know only too well that it can take years to make back a hundred thousand dollars! And— once you retire, you are basically unemployed. Your investments are your source of living and lifestyle for the next twenty or thirty years.

A loss like that can make you wonder what you’re doing in the stock market at all—unless you have plenty of other money in safe, income-producing assets. Otherwise, you will watch your investment balances throughout the day. That is the sure sign that your investments are not in line with your risk tolerance and time horizon.

Remember–a 30% Loss Requires a 43% Gain To Break Even, and a 50 percent Loss Requires a 100% Gain to Break Even. That can take years. Markets may defy gravity at times but reversion to the mean is a mathematical principal you must never ignore, in fact you can’t. You won’t have to look for it, it will find YOU.

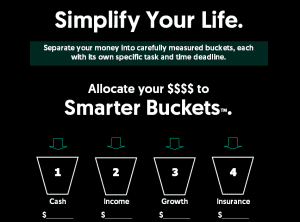

This is why a financial bucketing strategy in retirement is so effective. You separate your income capital from your growth capital. When markets fall, your income bucket is not affected whatsoever. If you are a dividend investor reinvesting dividends, your growth bucket benefits from the downturn. As with the Black Diamond Dividend Strategy, your steadily increasing dividends buy you even more shares of great companies during market dips.

Insure your income, insure your outcomes, invest the rest with purpose! With markets high, but unstable, your financial plan for retirement probably needs an adjustment. This is an excellent time lock to make your move to more safety, security, income and math-based growth.

Steve Jurich is an Accredited Investment Fiduciary®, Investment Manager, and a Certified Annuity Specialist®. His financial planning practice is located in Scottsdale, Arizona. www.IQWealth.com