The market is reacting to President Trump’s tough stance on Chinese theft of our intellectual property.

If he doesn’t take a stand now, China will own us outright in ten to twenty years.

Having to pay a few more bucks for consumer staples for a year or two is a small price to pay.

We need to re-build our middle class here in the USA, and stop Chinese companies from buying up all of our companies for their trade secrets.

Don’t ever buy into the propaganda that “China can cancel our debt”.

They have already sold off a large chunk of our treasury bonds–and we are still standing.

They need us as much as we need them, and they are NOT the biggest holder of our treasury bonds.–by a long shot.

Markets are jittery, but markets should be jittery when valuations are high and the market has been going up for so long.

Expecting volatility is good for your mental health–as long as you keep your “don’t touch” money working safely for you.

Over the past five years I’ve met at least 20 people with significant assets who regret selling at the bottom in 2009.

They watched as the market has roared back to all-time high’s.

High markets don’t stay high forever, but they do tend to raise the bar to where we are headed after the next big correction.

Markets can come back in five days, five weeks, five months,or five years–no one knows how long it will take.

But markets do come back eventually.

Getting scared at market bottoms is a normal reaction for anyone who has worked and saved their whole lives.

This is especially true for investors who tie up all their capital in risk assets on Wall Street.

As an investor, you know that pull-backs are part of the process

We need the night to appreciate the day, and we need a stock market adjustment to find better opportunities

At IQ Wealth Management, we have been hardly waiting for stronger pull-backs.

If you are an IQ Wealth investor, you are prepared.

Pull-backs will always happen. Having a strategy for it, matters.

This is why we believe in the sound logic of keeping a percentage of your assets safe and secure, away from market risk–especially in retirement.

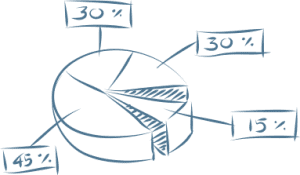

The percentage we favor is the same as your age: if you are 60 years old, keep 60% out of harm’s way.

If you are 70, keep 70% out of harm’s way

Make sure the money you keep out of harm’s way is working very hard, not just sitting all in cash

Your safe money should be building and growing a future income, addressing long term care benefits, and addressing future inflation.

The current volatility further proves our point:

Allocating properly into Buckets #1 (cash equivalents) and Buckets #2 (low risk contractually guaranteed income without market risk) is the only way to “play” this market.

Buckets 1 & 2 take care of your short run and income for the long run. Bucket 3 should be allowed to do its work.

We will say it a million more times to prudent people who are willing to listen to preserve their retirements:

–keep income money and growth money separated from each other.

The reasons are simple–and demonstrated during weeks like this.

You should always invest according to your age:

At age 34, investing is all about the long term–have at it.

At age 64, half your money needs to be about living life to the fullest–without worry–NOW

That means having guaranteed sources of income that last as long as you do

The other half–your equities–will see their ups and downs, but by not having to panic and sell (because all your bills are paid) you can let cycles play out.

You can also let your investment managers take advantage of significant pull-backs in the market. Which we are doing and planning.

What to do now:

Nothing. (If you are a client of ours)

We have been hardly waiting for a nice pull-back in order to bolster your account with high value targets.

This one may not be “the big one.” We have adjusted cash positions in our portfolios to put you in a strong position and will be re-balancing soon.

Our calculations haven’t changed.

In summary–if you are a client, you are in a good position–relax.

You own quality.

The companies that you own in the Diamond portfolios ( if we are managing your investments), make money in the REAL world, not just the crazy world of the stock market.

The crazy market tends to find it’s way back to quality eventually–when all else fails.

You are already there.

Your investments are well positioned

Your annuities are safe

Things will get better, and we are on top of it.

In the meantime, enjoy life and create some memories.

For Information on IQ Wealth Dividend Strategies:

Black Diamond Dividend Strategy Blue Diamond Income & Growth