The Future of Retirement Income Starts Here

Next-Generation Retirement Annuities Are Redefining Retirement Planning.

Today’s retirees are seeking advanced income solutions—because while markets go up, they also come down. When they do, you need a stable, reliable income that lasts through thick and thin. The issue? Bonds don’t pay enough, and pensions have gone the way of the dinosaur.

Studies from MIT, Wharton, and more confirm that lifetime income annuities fill this gap. Today’s NEXT-Generation Retirement Annuities can provide permanent income, often double or triple that of quality bonds—AND like a pension, the income is inexhaustible. But unlike old annuities, these modern options protect your heirs—meaning the insurance company doesn’t keep your money when you pass.

But how do you find the right one? The IQ Wealth® Annuity Comparison System™ gives you the power to review up to 1,200+ annuities with an experienced planner. This could be your opportunity to strengthen your 401(k), 403(b), 457, TSP, or IRA Rollover. Learn how to achieve a safe income rate for life between 5.2% and 14.6%, depending on age and deferral period.

Our proven approach puts you in the driver’s seat—with no sales pressure, ever.

Important

Annuities from legal reserve life insurance companies are licensed and audited in all 50 states. The right annuity can provide more than enough lifetime income, protect you from market loss, and protect your heirs. By comparing your options, you can find the one that best fits your retirement goals.

Lifetime Income

5-14.6%

Annuity Bonus

7-30%

- Modern Fixed Index Annuities

- Income Based on Age and Deferral Period

- No Annuitizing Required

- Guaranteed Lifetime Withdrawal Benefit (GLWB)

- Your Principal Remains Reasonably Liquid

- Guaranteed Lifetime Income Paid Monthly

- Protected from Market Risk

- Bonuses on the Lifetime Income or Principal

Past performance of any asset or index should never be relied upon to predict future results. No specific product or company being promoted. Guarantees rely on the financial strength of the issuing insurer. Not FDIC insured, not a bank deposit.

Next-Generation Annuities: More Income, More Control

Enjoy fixed income for life—like a pension—but with full control over your money. Unlike old-style annuities, the insurance company won’t keep your money when you pass.

In the past, the only way to get lifetime income from an annuity was to “annuitize”—meaning you had to give up your principal in exchange for income. That idea is dead and gone.

Thanks to the Guaranteed Lifetime Withdrawal Benefit (GLWB), there’s no need to annuitize anymore. For those who want to Retire and STAY Retired with lasting high income, Next-Generation Retirement Annuities provide the answer.

These newer Next-Generation Annuities can far outperform quality bonds by two or three times. Depending on age and deferral period, they can provide a permanent income rate of 5.2% to 14.6%—guaranteed for life.

But here’s the key: it’s all about finding the right one. Some Next-Generation Annuities pay up to 40% more than others, making it crucial to compare options with an experienced advisor—preferably a Certified Annuity Specialist®.

Guaranteed Lifetime Withdrawal Benefit (GLWB): Income You Can’t Outlive

Retirement is about peace of mind—knowing that your income will last as long as you do. With a Guaranteed Lifetime Withdrawal Benefit (GLWB), you gain predictable, secure income for life, no matter how the markets perform.

Unlike traditional retirement accounts, where withdrawals can dwindle your savings over time, a GLWB ensures that you receive a steady stream of income—even if your account balance drops to zero.

Here’s how it works:

- Your money stays under your control

Your principal continues to grow based on market or fixed interest performance. - Income is locked in for life

Once you activate withdrawals, your income is guaranteed—you can never outlive it. - Protection against market downturns

Even if the market declines, your withdrawal benefit remains intact. - Flexibility for your future

Some plans allow for increasing income to help offset inflation. - The Smart Alternative to Annuitization

With a GLWB, you get guaranteed lifetime income without giving up control of your principal. Unlike traditional annuities, your heirs can still receive your remaining balance—giving you both security and financial freedom.

With today’s advancements in annuity strategies, GLWBs provide more control, higher payout rates, and greater peace of mind than ever before. It’s a smart way to turn your retirement savings into a secure paycheck for life—without giving up access to your money.

Recent Lifetime Income Examples

Age 64, Deferred 4 Years, Annual Guaranteed Income

(Annual income may be taken monthly for life)

Case Study

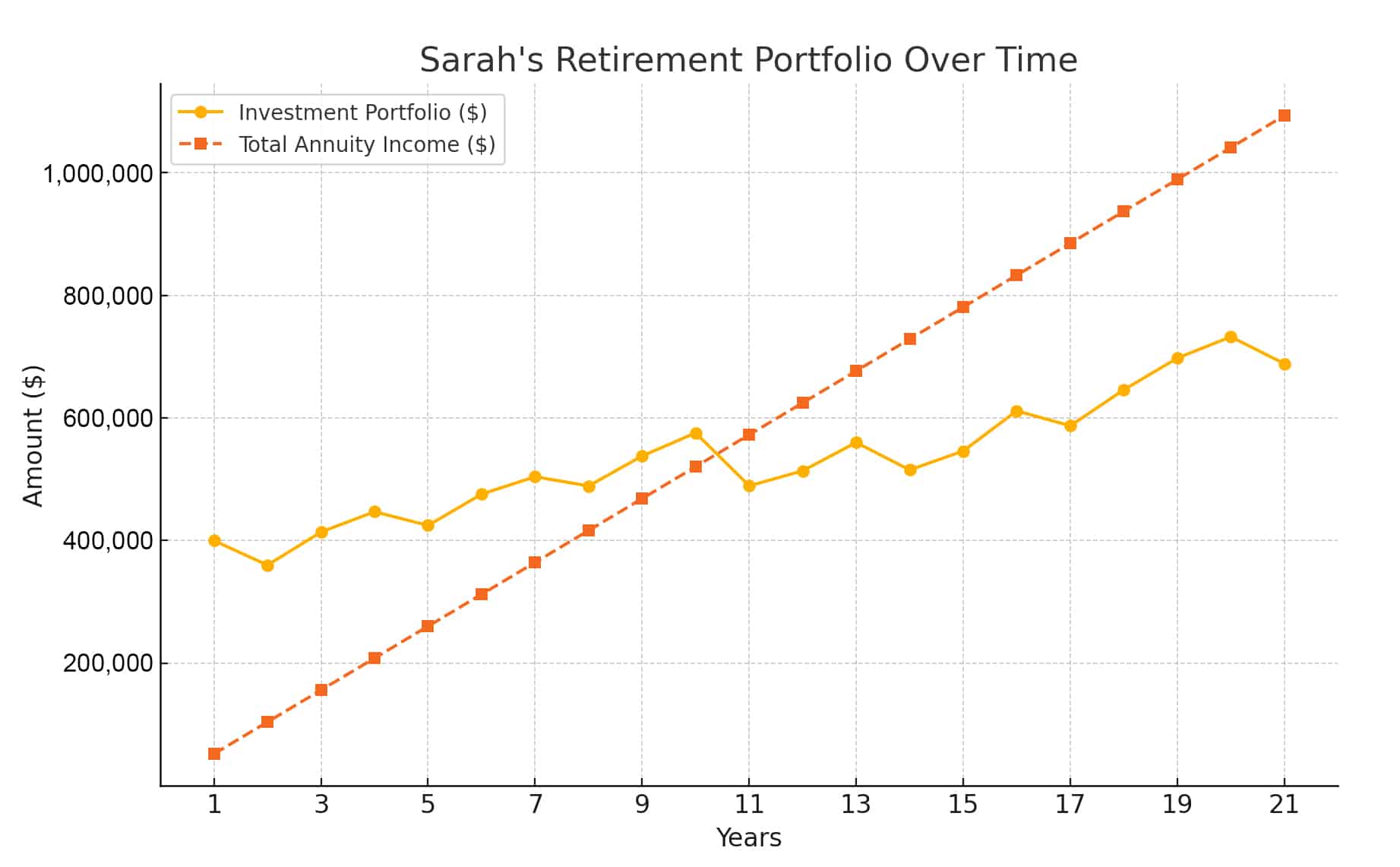

How Sarah Secured Lifetime Income and Market Growth

Meet Sarah:

A 65-year-old retiree with a $1,000,000 portfolio. Sarah wants reliable income in retirement without sacrificing growth potential.

Her Strategy: Balance and Security

Instead of risking her entire portfolio in the stock market, Sarah split her assets. Sarah purchased her annuity when she was 61, with a plan to start taking income when she was 65:

- $500,000 in a Next-Gen Annuity—guaranteeing her a steady income stream for life.

- $500,000 in Market Investments—allowing for long-term growth potential.

Results After 21 Years

Total Guaranteed Annuity Income: $1,093,302

Investment Portfolio Growth: $688,606

Even with a bad initial sequence of returns after she retired, her income carried her through the down market. This allowed her investments to recover and grow over time without ever having to be touched for extra income. Due to her Next-Gen Annuity with a GLWB, her income was guaranteed for life even if she ran out of principal.

| Year | Market Return | Sarah's Investment Portfolio | Sarah's Annuity Income |

|---|---|---|---|

| Start | $500,000 | ||

| 1 | -20% | $400,000 | $52,062 |

| 2 | -10% | $360,000 | $52,062 |

| 3 | 15% | $414,000 | $52,062 |

| 4 | 8% | $447,120 | $52,062 |

| 5 | -5% | $424,764 | $52,062 |

| 6 | 12% | $475,736 | $52,062 |

| 7 | 6% | $504,280 | $52,062 |

| 8 | -3% | $489,151 | $52,062 |

| 9 | 10% | $538,067 | $52,062 |

| 10 | 7% | $575,731 | $52,062 |

| 11 | -15% | $489,372 | $52,062 |

| 12 | 5% | $513,840 | $52,062 |

| 13 | 9% | $560,086 | $52,062 |

| 14 | -8% | $515,279 | $52,062 |

| 15 | 6% | $546,196 | $52,062 |

| 16 | 12% | $611,739 | $52,062 |

| 17 | -4% | $587,270 | $52,062 |

| 18 | 10% | $645,996 | $52,062 |

| 19 | 8% | $697,676 | $52,062 |

| 20 | 5% | $732,560 | $52,062 |

| 21 | -6% | $688,606 | $52,062 |

| End | — | $688,606 | $1,093,302 |

Licensed With All Carriers

We Independently Review 1200+ Annuities For You

Common Annuity Myths Explained

Aren’t Annuities Too Expensive?

Misconception: Many assume annuities have high fees like mutual funds.

Reality: Next-Generation Annuities can offer zero advisory fees, and 100% of your money starts working for you on day one.

Solution: Compare annuities with a education-first approach to ensure you’re getting the best value.

What If I Die Early? Do I Lose My Money?

Old-School Myth: Traditional annuities did require "annuitization," meaning you lost control of your money.

Modern Reality: Next-Generation Annuities allow your heirs to inherit any unused portion.

Solution: Many annuities come with return-of-premium options and beneficiary protections.

Why shouldn't I Just Invest in Stocks and Withdraw as Needed?

- Stock Market Risk: Market downturns can force you to sell assets at a loss, reducing your income over time.

- Sequence of Returns Risk: Even a small crash early in retirement can permanently impact your portfolio.

- Annuity Advantage: Provides guaranteed lifetime income, removing withdrawal risk and market uncertainty.

Don't Annuities Have High Fees?

- Not all annuities have high fees—some have zero fees, and 100% principal allocation.

- Variable annuities often have high costs, but fixed indexed annuities, also known as Next-Generation Annuities have ZERO fees.

- The right annuity is cheaper and safer than mutual funds, which have ongoing management fees.

Aren’t Annuities Just for Old People?

Myth: Annuities are only for seniors.

Reality: Annuities are for anyone looking for guaranteed lifetime income.

- Many pre-retirees (40s & 50s) use annuities for tax-efficient growth and protected future income.

The power of deferral may increase the income you receive from your Next-Generation Annuity, while avoid damage from market downturns.

Will My Money Be Locked Up Forever?

- Many annuities allow penalty-free withdrawals (often up to 10% per year).

- Liquidity features ensure you still have access to funds if needed.

- You can also ladder annuities for flexibility.

Always make sure you compare annuities with a experienced advisor to make sure you understand everything about your annuity.

At IQ Wealth®, we have been helping people retire and stay retired for over 20 years.

Aren’t Annuities Too Complicated?

Concern: Some annuities are complex.

Solution: Not all annuities are the same—comparison tools like the IQ Wealth Annuity Comparison System™ help find the best fit for you.

Are Annuities Safe?

- Legal Reserve Life Insurance Companies back annuities, and they are licensed & audited in all 50 states.

- Many annuities come with guarantees backed by multi-billion-dollar insurance companies.

Can I Get Better Returns Elsewhere?

- Growth assets (stocks, real estate, etc.) can provide high returns but come with risk.

- Annuities offer guaranteed income, ensuring your lifestyle is protected even if markets crash.

- Next-generation annuities allow for upside growth while protecting against loss.

Compare Annuities

Review your annuity options with an Experienced Advisor and Certified Annuity Specialist®.

Keeping Your Retirement Goals Front and Center

As we continue the planning process, your retirement goals remain our top priority. Clearly defining the kind of retirement you envision allows us to strategically align each asset with a specific purpose and timeline—ensuring your money works for you, when you need it.

At this stage, most of our clients have important questions, such as:

- Social Security: When is the best time to start collecting?

- Required Minimum Distributions (RMDs): How will they impact your taxes and income?

- Current Portfolio Review: What’s working, what’s not, and what adjustments make sense?

- Retirement Security: How protected are you from market volatility?

- Mutual Fund Concerns: Are they too risky for your retirement goals?

- Risk Reduction & Income Growth: How can you create more stability?

- Tax Strategies: How can you minimize your tax burden in retirement?

- IRA Rollovers & Roth Conversions: Are they the right move for you?

- Investments & Annuities: What role should they play in your financial plan?

- “Are annuities really safe?” (Hint: It depends on the type of annuity and how it’s structured.)

If you have additional questions, we’re here to answer them all—ensuring you feel confident and in control of your retirement future.

Your First Meeting

Scheduling your first meeting or phone call? Here’s what you can look forward to—no pressure, no sales tactics, and definitely no "used car" experience.

At IQ Wealth®, we start every conversation with one simple question: “What are your goals?” From there, we craft a strategy designed to turn those goals into reality.

For over 20 years, we’ve been committed to delivering unmatched client care and personalized financial guidance. Our approach ensures you can retire confidently in any economy by addressing the five key areas of retirement planning:

- Income Planning – Ensuring you have a steady, reliable retirement paycheck.

- Legacy Planning – Protecting your assets and passing wealth efficiently.

- Tax-Efficient Strategies – Minimizing taxes to maximize your income.

- Asset Protection – Safeguarding your wealth from market downturns.

- Growth Strategies – Keeping your portfolio positioned for long-term success.

At IQ Wealth®, our goal is simple: to help you retire smarter, safer, and with financial confidence.

FAQ

What happens when I become a client?

Becoming a client at IQ Wealth is a structured, stress-free process designed for clarity and confidence. We typically follow three steps:

- Discovery Meeting – Understanding your goals and needs.

- Plan Creation – Crafting a tailored financial strategy.

- Implementation – Putting your plan into action (which may begin as early as the second meeting).

We focus on education, transparency, and a world-class planning experience—without any sales pressure.

Are there any advisor fees for annuities?

No. The annuities we recommend have zero advisory or management fees. We are compensated by the insurance company, but 100% of your money starts working for you on day one. As an independent agency, we compare options from 50+ companies with a education-first approach.

What are your investment portfolio management fees?

Our fee arrangement is very simple. We charge one flat fee of 0.95%, which is all inclusive. You pay no transaction fees, no commissions, no junk fees. Our minimum is typically $200,000 but we can work with portfolios of $100,000+.

What are your qualifications?

Our team holds CAS® (Certified Annuity Specialist), and CIS™ (Certified Income Specialist) designations. IQ Wealth is an A+ Accredited Member of the Better Business Bureau, fully licensed in securities and insurance.

How much does a retirement plan cost?

For clients implementing our recommendations, there is no charge. This includes:

- Guaranteed income projections (not hypothetical models).

- Social Security timing optimization.

- Inflation protection strategies.

This is a $1,250 value, provided free to clients.

Compare Annuities

Review your annuity options with an Experienced Advisor and Certified Annuity Specialist®.

Schedule a Meeting

Use this form to begin scheduling your office meeting or 15 minute phone call.

Next Steps

Step 1

Fill out the form.

Step 2

We'll contact you to schedule.