Are Fixed Index Annuities the Retirement Income Missing Link?

Today’s Modern Annuities solve the no-paycheck problem—without giving up control.

- Lock In Today’s Best Fixed Index Annuity Rates & Bonuses

- Access to all top annuity providers with no captive-agent restrictions

- Income that’s often 2-3x Quality Bonds, CDs, and Traditional Fixed Annuities

- Upside growth tied to a market index — with no risk of market loss.

- Principal Protection with a 0% Downside Floor

- Fast, convenient process—handled quickly, no delays.

- Independently Licensed with All Carriers

- Work with an Experienced Advisor and Certified Annuity Specialist®

- Get Honest Answers, Ethical Comparisons, and a Clear Strategy.

Step 1:

Clarify Your Priorities and Define Your Goals

Start with a quick call to discuss what matters most to you about retirement and annuities—like guaranteed income, bonus potential, long-term growth, flexibility, protection for your heirs, and more.

Step 2:

See the Top Annuity Options Side-by-Side

Compare the highest-performing annuities matched to your goals. Evaluate income, rates, fees, and bonus structures with an experienced advisor who cuts through the fine print—so you know exactly what you’re getting.

Step 3:

Lock In Rates and Move Forward with Confidence

Get full clarity on your best fixed index annuity options. Income rates are locked in, your questions are answered, and the application process is made easy—managed step-by-step by our team for a smooth, confident transition.

Lifetime Income

5-14.6%

Annuity Bonus

7-30%

Compare Fixed Index Annuities

Review your fixed index annuity options with a Certified Annuity Specialist® and experienced advisor.

Retirement Planning Isn’t About Assets—It’s About Replacing Your Paycheck

Let’s face the facts: Social Security alone won’t cover everything. It may handle the basics—but is your goal to live a basic retirement? Of course not. With no more paycheck from work, you have an income gap to keep living the way you want to. You need more income, preferably income that doesn’t go away or reduce when the market fluctuates. Your income plan must meet or EXCEED your living and lifestyle expenses—from now on, no matter what.

Old Annuities Don’t Fill the Gap Well

Immediate annuities lock up your money. Variable annuities expose your income to market losses and high fees. Traditional fixed annuities offer safety—but pay too little. These older products may come at a high cost and force undesirable trade-offs.

Fixed Index Annuities Change the Equation

Fixed Index Annuities — also known as Next-generation or “Hybrid” annuities — do a much better job of filling the income gap. They offer higher guaranteed income, market-linked growth, downside protection, and more control. When structured properly, they can continue paying the same high income—even if your principal runs out.

A Smarter Way to Fund Retirement—Without Sacrificing Growth

When income is guaranteed to meet or exceed your lifestyle needs, your growth investments no longer have to carry the burden. That frees up the rest of your portfolio to focus on long-term performance—while you enjoy a stable, confident retirement.

This is one of the fundamentals of Smart Retirement Planning: separate your income and growth into distinct “buckets.” It’s how you keep your income secure while still giving your assets room to grow.

Recent Lifetime Income Examples

Fixed Index Annuities (FIA), Age 64, Deferred 4 Years, Annual Guaranteed Income

(Annual income may be taken monthly for life)

Over $200 Million placed in annuities under fiduciary guidance.

Licensed With All Carriers

Case Study

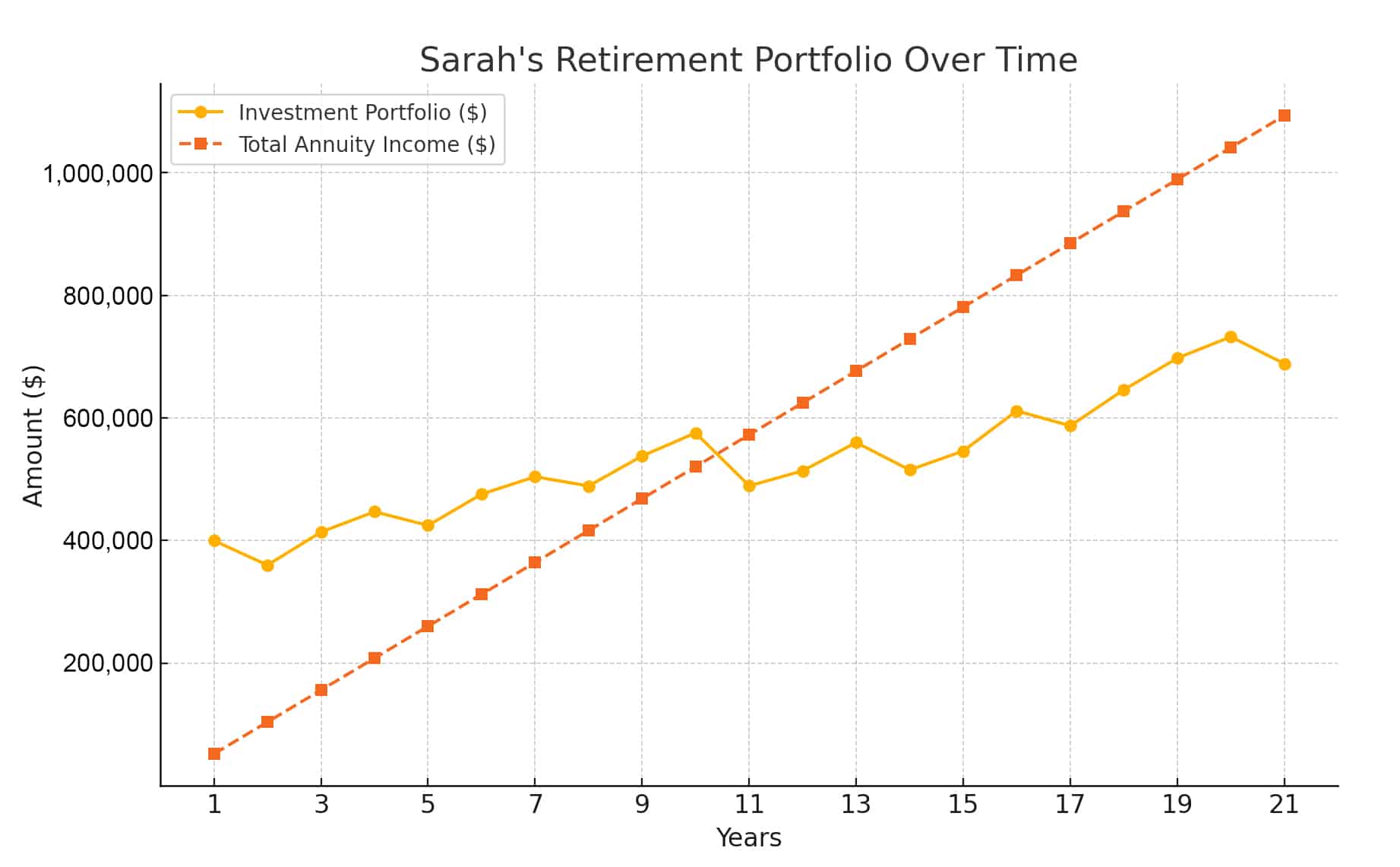

How Sarah Used a Fixed Index Annuity to Lock In Over $1,000,000 in Guaranteed Income Over 20 years

While the Markets fluctuated, her annuity income stayed 100% consistent—and never experienced a single market loss.

Meet Sarah:

A 65-year-old retiree with a $1,000,000 portfolio. Sarah wants reliable income in retirement without sacrificing growth potential. She wants to make sure that her income is covered for as long as she lives.

Her Strategy: Income First

Instead of risking her entire portfolio in the stock market, Sarah split her assets. Sarah purchased her fixed index annuity when she was 61, with a plan to start taking income when she was 65, a four year deferral period:

- $500,000 in a Fixed Index Annuity (FIA)—guaranteeing her a steady income stream for life.

- $500,000 in Market Investments—allowing for long-term growth potential.

Results After 21 Years

Total Guaranteed Annuity Income: $1,093,302

Sarah’s FIA income carried her through the down market, protecting her from loss. This allowed her market investments to recover and grow over time without ever having to be touched for extra income. Due to her Fixed Index Annuity with a GLWB, her income was guaranteed for life even if she ran out of principal. At 85, she still had more than enough income. Even if she lives to 100 or beyond, it will continue to keep paying her—no matter what.

| Age | Sarah's Annuity Income | Market Return | Sarah's Investment Portfolio |

|---|---|---|---|

| Start | $500,000 | ||

| 65 | $52,062 | -20% | $400,000 |

| 66 | $52,062 | -10% | $360,000 |

| 67 | $52,062 | 15% | $414,000 |

| 68 | $52,062 | 8% | $447,120 |

| 69 | $52,062 | -5% | $424,764 |

| 70 | $52,062 | 12% | $475,736 |

| 71 | $52,062 | 6% | $504,280 |

| 72 | $52,062 | -3% | $489,151 |

| 73 | $52,062 | 10% | $538,067 |

| 74 | $52,062 | 7% | $575,731 |

| 75 | $52,062 | -15% | $489,372 |

| 76 | $52,062 | 5% | $513,840 |

| 77 | $52,062 | 9% | $560,086 |

| 78 | $52,062 | -8% | $515,279 |

| 79 | $52,062 | 6% | $546,196 |

| 80 | $52,062 | 12% | $611,739 |

| 81 | $52,062 | -4% | $587,270 |

| 82 | $52,062 | 10% | $645,996 |

| 83 | $52,062 | 8% | $697,676 |

| 84 | $52,062 | 5% | $732,560 |

| 85 | $52,062 | -6% | $688,606 |

| Totals | $1,093,302 | — | $688,606 |

These hypothetical examples illustrate concepts only and do not reflect any specific product, company, or individual situation. Income rates vary based on age and deferral period. Past performance is never a guarantee of future results.

Compare Fixed Index Annuities

Review your fixed index annuity options with a Certified Annuity Specialist® and experienced advisor.

Guaranteed Lifetime Withdrawal Benefit (GLWB): Income You Can’t Outlive

Retirement is about peace of mind—knowing that your income will last as long as you do. With a Guaranteed Lifetime Withdrawal Benefit (GLWB), you gain predictable, secure income for life, no matter how the markets perform.

Unlike traditional retirement accounts, where withdrawals can dwindle your savings over time, a GLWB ensures that you receive a steady stream of income—even if your account balance drops to zero.

Here’s how it works:

- Your money stays under your control

Your principal continues to grow based on market or fixed interest performance. - Income is locked in for life

Once you activate withdrawals, your income is guaranteed—you can never outlive it. - Protection against market downturns

Even if the market declines, your withdrawal benefit remains intact. - Flexibility for your future

Some plans allow for increasing income to help offset inflation. - The Smart Alternative to Annuitization

With a GLWB, you get guaranteed lifetime income without giving up control of your principal. Unlike traditional annuities, your heirs can still receive your remaining balance—giving you both security and financial freedom.

With today’s advancements in annuity strategies, GLWBs provide more control, higher payout rates, and greater peace of mind than ever before. It’s a smart way to turn your retirement savings into a secure paycheck for life—without giving up access to your money.

Past performance of any asset or index should never be relied upon to predict future results. No specific product or company being promoted. Guarantees rely on the financial strength of the issuing insurer. Not FDIC insured, not a bank deposit.

Fixed Index Annuities: More Income, More Control

Enjoy fixed income for life—like a pension—but with full control over your money. Unlike old-style annuities, the insurance company won’t keep your money when you pass.

In the past, the only way to get lifetime income from an annuity was to “annuitize”—meaning you had to give up your principal in exchange for income. That idea is dead and gone.

Thanks to the Guaranteed Lifetime Withdrawal Benefit (GLWB), there’s no need to annuitize anymore. For those who want to Retire and STAY Retired with lasting high income, Next-Gen Fixed Index Annuities provide the answer.

These newer Fixed Index Annuities (FIA) can far outperform quality bonds by two or three times. Depending on age and deferral period, they can provide a permanent income rate of 5.2% to 14.6%—guaranteed for life.

But here’s the key: it’s all about finding the right one. Some Annuities pay up to 40% more than others, making it crucial to compare options with an experienced advisor—preferably a Certified Annuity Specialist®.

Fixed Index Annuity FAQs

Q: What is a Fixed Index Annuity (FIA), exactly?

Answer: It’s a retirement vehicle that protects your principal, earns interest based on the performance of a market index (like the S&P 500), and offers guaranteed income for life—with no risk of market loss.

Q: How does the income guarantee work?

Answer: FIAs with a Guaranteed Lifetime Withdrawal Benefit (GLWB) offer a fixed, contractually guaranteed income stream—based on your age, deferral period, and the amount you invest. It keeps paying even if your account balance runs out.

Q: Do I lose access to my money once income starts?

Answer: No. Unlike traditional annuities that require annuitization, FIAs with a GLWB let you keep control. You can still access the principal (within the contract terms), and any remaining value goes to your heirs.

Q: What are surrender charges, and how do they work?

Answer: Most annuities have a surrender period (usually 7–10 years) where withdrawals above the allowed amount (often 10% per year) may trigger a fee. We help you understand these clearly and only recommend contracts where the benefits far outweigh any limitations.

Q: How do these compare to bonds or CDs?

Answer: FIAs often offer 2–3x the income of bonds, CDs, or fixed annuities, along with tax deferral and principal protection. Unlike bonds, you won’t lose money in a down market.

Q: Can I add long-term care or legacy protection?

Answer: Yes. Many top FIAs allow you to add optional benefits, like enhanced death benefits or long-term care access. These may cost extra but can be worth considering depending on your needs.

Q: Are there fees involved?

Answer: An annuity typically has no advisory fee.

Q: What happens to the money when I pass away?

Answer: Any remaining account value can go to your spouse or named beneficiaries. Unlike older-style annuities, the insurance company doesn’t “keep the money” when you die.

Q: Will this affect my taxes?

Answer: FIAs grow tax-deferred. You won’t pay taxes until you begin taking income, and then it’s taxed as ordinary income. This can help reduce your tax exposure during accumulation years.

Q: Can annuity income count toward my Required Minimum Distributions (RMDs)?

Answer: Yes. If your annuity is held within a qualified retirement account—such as a traditional IRA or 401(k)—the income you receive from it can count toward satisfying your annual RMD requirement.

Q: If I’m older and already retired, but want to improve my income, how does a Fixed Index Annuity benefit me?

Answer: The income from a Fixed Index Annuity is based on your age and how long you defer before taking withdrawals. The older you are, the higher your guaranteed payout rate—so even if you’re already retired, you may qualify for significantly more income than someone younger. Many retirees use FIAs to increase their income by moving funds from low-yield CDs, bonds, or riskier investments into an annuity that offers guaranteed income for life, without market losses.

Q: What if I already own an annuity—can you still help?

Answer: Yes. If you have an older annuity with lower payout rates and little or no surrender charge remaining, we can help you evaluate whether it makes sense to replace it with a modern Fixed Index Annuity that offers higher guaranteed income. This process is often referred to as annuity refinancing. We’ll review your existing contract and show you side-by-side comparisons so you can make an informed decision.

Compare Fixed Index Annuities

Review your fixed index annuity options with an Experienced Advisor and Certified Annuity Specialist®.

Keeping Your Retirement Goals Front and Center

As we continue the planning process, your retirement goals remain our top priority. Clearly defining the kind of retirement you envision allows us to strategically align each asset with a specific purpose and timeline—ensuring your money works for you, when you need it.

At this stage, most of our clients have important questions, such as:

- Social Security: When is the best time to start collecting?

- Required Minimum Distributions (RMDs): How will they impact your taxes and income?

- Current Portfolio Review: What’s working, what’s not, and what adjustments make sense?

- Retirement Security: How protected are you from market volatility?

- Mutual Fund Concerns: Are they too risky for your retirement goals?

- Risk Reduction & Income Growth: How can you create more stability?

- Tax Strategies: How can you minimize your tax burden in retirement?

- IRA Rollovers & Roth Conversions: Are they the right move for you?

- Investments & Annuities: What role should they play in your financial plan?

- “Are annuities really safe?” (Hint: It depends on the type of annuity and how it’s structured.)

If you have additional questions, we’re here to answer them all—ensuring you feel confident and in control of your retirement future.

Your First Meeting

Scheduling your first meeting or phone call? Here’s what you can look forward to—no pressure, no sales tactics, and definitely no "used car" experience.

At IQ Wealth®, we start every conversation with one simple question: “What are your goals?” From there, we craft a strategy designed to turn those goals into reality.

For over 20 years, we’ve been committed to delivering unmatched client care and personalized financial guidance. Our approach ensures you can retire confidently in any economy by addressing the five key areas of retirement planning:

- Income Planning – Ensuring you have a steady, reliable retirement paycheck.

- Legacy Planning – Protecting your assets and passing wealth efficiently.

- Tax-Efficient Strategies – Minimizing taxes to maximize your income.

- Asset Protection – Safeguarding your wealth from market downturns.

- Growth Strategies – Keeping your portfolio positioned for long-term success.

At IQ Wealth®, our goal is simple: to help you retire smarter, safer, and with financial confidence.

FAQ

What happens when I become a client?

Becoming a client at IQ Wealth is a structured, stress-free process designed for clarity and confidence. We typically follow three steps:

- Discovery Meeting – Understanding your goals and needs.

- Plan Creation – Crafting a tailored financial strategy.

- Implementation – Putting your plan into action (which may begin as early as the second meeting).

We focus on education, transparency, and a world-class planning experience—without any sales pressure.

Are there any advisor fees for annuities?

No. The annuities we recommend have zero advisory or management fees. We are compensated by the insurance company, but 100% of your money starts working for you on day one. As an independent agency, we compare options from 50+ companies with a education-first approach.

What are your investment portfolio management fees?

Our fee arrangement is very simple. We charge one flat fee of 0.95%, which is all inclusive. You pay no transaction fees, no commissions, no junk fees. Our minimum is typically $200,000 but we can work with portfolios of $100,000+.

What are your qualifications?

Our team holds CAS® (Certified Annuity Specialist), and CIS™ (Certified Income Specialist) designations. IQ Wealth is an A+ Accredited Member of the Better Business Bureau, fully licensed in securities and insurance.

How much does a retirement plan cost?

For clients implementing our recommendations, there is no charge. This includes:

- Guaranteed income projections (not hypothetical models).

- Social Security timing optimization.

- Inflation protection strategies.

This is a $1,250 value, provided free to clients.

Compare Fixed Index Annuities

Review your fixed index annuity options with an Experienced Advisor and Certified Annuity Specialist®.

Schedule a Meeting

Use this form to begin scheduling your office meeting or 15 minute phone call.

Retirement

Review

Step 1

Fill out the form.

Step 2

We'll contact you to schedule.