The joy and solid feeling you get from knowing your money will protect your life and your lifestyle as long as you live is a good one. Billionaires get that feeling because it is pretty hard to screw up a plan that starts out with a billion dollars. But let’s face it…isn’t he really just trying to sell you his stuff?

Annuity Critics–like the “Grumpy Old Billionaire” on TV who “hates” annuities and thinks you should, too–are just trying to sell you something else.

They’ve not sat down with your to consider your desire for safety, security and income. They just spew blanket advice that everyone is supposed to follow. Here’s the reality: Billionaires don’t need safe, secure income and protection from bear markets in order to feel comfortable. But you do.

Every year, more retiring engineers, teachers, health care professionals, managers, lawyers, accountants, and tech workers choose annuities for all or part of their 401k, 403b & IRA rollovers. Why?

- Preservation of principal

- Certainty of income for 2 spouses from the same IRA

- More income than bond funds, with better safety

- A way to “buy a pension”, without “locking up” your money

- Strong diversification (non-correlated to stock market or real estate.)

So, ask yourself. Is your retirement income truly secure? If you’re married, do you have an income plan in place for when one of you passes away? Securing retirement income for life— for both you and your spouse– is the single most important first step in financial planning for retirement. Once your income is in position to exceed your expenses for the rest of your life, come what may, you have the basis of solid financial plan. From there you can branch out into growth investments.

Investing in retirement is complicated and risky because your contributions switch to withdrawals.

As more employers move away from pension plans to 401k plans, smart retirees are recognizing that the right annuity can be the practical workaround. Using an annuity for all or part of your IRA rollover is a way to combine a conservative investment with exceptional lasting income–like a pension.

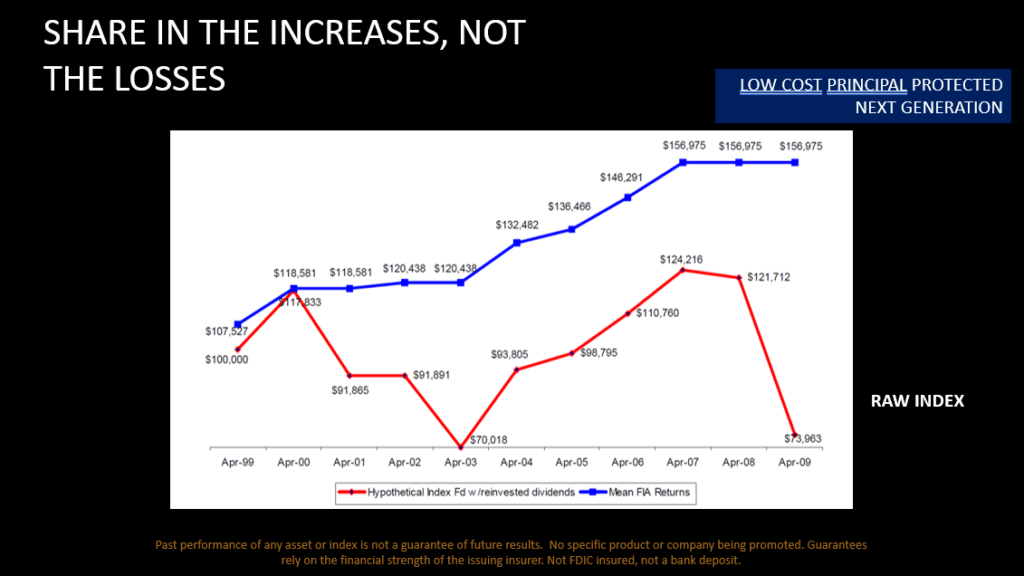

Today’s uncapped NEXT GENERATION retirement annuities can make life simple again. You may stay in control of your principal while your income grows. You move up with the index, never down, forward never back. Many people want to skip the risk of the market and just collect paychecks (mailbox money). With the right annuity, you can do that, and you never experience a market loss.

No management or advisor fees

There is never any management fee, commission, or advisor fee deducted from your principal on the top annuities we recommend. And, you may enjoy a lifetime income like a pension–without “annuitizing.” The income rate can be very high: in the realm of 5% to 9% for life or more, depending on age and deferral period. You stay in control of your money and the insurance company does NOT keep it when you die. Your heirs get every penny you don’t spend.

All annuities are not alike, just as all homes and cars are not alike. Compare with a fiduciary.

The biggest mistakes you can make are:

- Turning off your mind and accepting what you hear as “reality”

- Not doing your own research

- Not meeting with a true, experienced annuity advisor who is also a bonafide retirement planner.

We’re happy to help you compare annuities and share our years of research and experience with you.

Annuities are not your “whole plan.” Asset allocation is the key. We use our Smarter Bucketing plan to determine the correct amount for cash and liquidity, annuities, and growth investments. Together, this allocation process can tighten up the loose bolts on your plan.

What is the job of the annuity?

To beat the stock market? Of course not. The right annuity can form the foundation at the base of your permanent financial plan for retirement. It puts a cement floor under your money. The right annuity can fill the “uncertainty gap”–that space in your mind with what lies ahead. None of knows when a big market crash will come. Owning assets that can preserve principal and pay you and your spouse for life, without interruption, backed by regulated reserves is not just smart, it is very smart.

Is an annuity right for you?

Let’s find out. As an investment manager who can place your assets at Fidelity, I can help you build a retirement plan properly allocated to smart growth investments balanced by secure fixed income. Let’s meet soon to start building a plan that makes sense and that can weather the future financial storms that are surely headed our way. Your need for permanent, secure income and a floor under your core capital will never go away.

Just remember: anyone trying to talk you OUT of an annuity is trying to talk you INTO something else.

Steve Jurich is an Accredited Investment Fiduciary® and Investment Manager who advises clients on building better retirements. Hear his radio show Mastering Money: Monday thru Friday at 8am and 11am on Money Radio, AM1510.