Most investors in or near retirement are looking for three main things with their nest eggs:

1) ample liquidity

2) permanent, worry-free income to cover all expenses, and

3) an effective and systematic way to grow money in the stock market over time.

The stock market can be a source of GREAT wealth-building, but holds the risk that prices can fall hard, meaning you can’t keep all your eggs in that basket. Taking retirement income from an-up-down stock portfolio has many risks. Real estate is also up and down, and most of us would generally agree that this is a seller’s market, not a buyers market. Neither of these sources are “worry-free.”

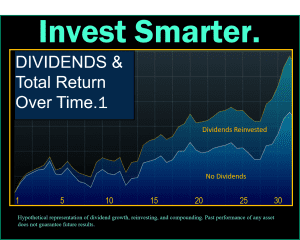

Where To Find Opportunities For Growth With stocks, you can still find good buys if you know where to look. The definition of a good buy is a stock wherein the price in relation to earnings and future growth potential is still a good bet. A blue chip dividend stock with a 4% dividend yield trading at 12-15 times earnings could be called a good buy, all things being equal. That said, a large cap growth-only stock like Amazon at 77 times earnings may still be a decent buy, with more upside even at today’s high price. It cannot be called a “value stock”, however. We all want to buy at rock bottom but we must realize that “rock-bottom” only occurs during deep market declines and recessions. Waiting around for those is like waiting around at the hangman’s gallows in the town square. If no one is committing crimes, you will waste a lot of time waiting for a hanging. And, it’s really not that much fun when it happens, right?

In the meantime, with your money working for you in a dividend growth portfolio, you could be realizing steady gains and collecting rising dividends for years while smiling all the way to the bank. When the crash comes (inevitable), your dividends can be reinvested into the same companies at bargain prices. Eventually, the market recovers and you own even more shares of great, profitable companies. You can then classify yourself as an investor, not a dabbler, market timer, or speculator. Market timers get it wrong most of the time, and get it very wrong some of the time. Why not be an investor, instead? After Eleven Years Of Upward Climbing, A Market Decline Is Out There Somewhere. But That Doesn’t Stop Smart Investors From Growing Their Capital With messy politics, a soaring debt, and international turmoil the norm, a reckoning is coming one day. That’s why so many more investors are getting a major share of their retirement money protected from the next market crash by re-allocating their retirement money into smarter buckets. Face it: A person who is retired needs to focus on income, liquidity preservation and prudent growth. Most of a retired person’s money should be out of harm’s way, especially when we are in the later stages of a bull market.

We haven’t seen a recession in over ten years, but one of these years, it will happen–and that’s the problem for a retired investor. Young people can recover without blinking an eye, but not retired folks. While many investors are attracted to the “sizzle” of growth and momentum stocks—especially when the market is rising—other investors prefer the “steak” of steady cash flow of dividend growth stocks alongside high income, low cost principal-protected annuities. When most of your money is allocated to income, preservation, and moderate growth you can look the future right in the eye because your financial plan won’t be derailed with a major market decline. You are more insulated from a crash. We all know that markets don’t always go up in a straight line, however, every once in a while, they can go DOWN in a straight line—like in 2008. At this stage of the game, can you really afford that?

In the old days, many retirees shifted all or most of their money to bonds in retirement. That was before rates on bonds came down to near zero. Because bonds that once paid seven percent now pay only two percent or less, certain types of annuities have emerged as perhaps the only logical choice for secure lifetime retirement income. Let’s be clear—I do not recommend immediate (“annuitized”) annuities where you hand over your principal to the insurance company. I also don’t recommend high cost variable annuities. I recommend deferred annuities featuring indexed interest, insured with Guaranteed Lifetime Withdrawal Benefit riders. These are secure principal-protected income annuities that don’t keep your money when you die. Today’s NEXT GENERATION of low cost, high income, retirement annuities with uncapped strategies and Guaranteed Lifetime Withdrawal Benefits are taking the place of bonds in a retirement portfolio for an increasing number of smart retiring professionals. Increasingly, you are seeing like engineers, teachers, health care professionals, doctors, attorneys, and business owners. Why annuities? Annuities add a pension dimension to your financial plan. You get a contract not a wish or a hope. In this crazy, volatile financial and political environment, hope is definitely not a strategy. Our goal is to completely eliminate market risk from at least half of your portfolio (more than half if you wish.) Imagine never having to worry about taking another market related loss as long as you live, yet sharing in the upward movements of your choice of market indexes. Imagine owning a lifetime income that can pay you and your spouse an income equivalent to five to nine percent for life depending on age and deferral period. At my firm, I compare up to 1200 annuities for my clients, and reject over 98 percent.

I help clients determine the correct amount to place in annuities to keep the balance they need. Would you like to know how to begin the process of properly allocating your retirement money? It begins by tossing out the rules of thumb and opinions you see all over the internet, and begin focusing on logic, math, priorities, risk tolerance, and your time horizon. Here are few good questions to ask yourself as you begin to think about your (re)allocation:

How long will it before you need to start withdrawing from your investments/savings for steady retirement income? (Assuming you already have sufficient liquid capital for short term cash flow and/or emergencies.) ___a) In 2 years or less. (1 point) ___b) Within 3 – 5 years. (3 points) ___c) Within 6 – 10 years. (4 points) ___d) Not for 10 + years. (5 points) The table below shows the highest one-year gain and highest one-year loss on four different hypothetical investments of $100,000. Given the potential gain or loss in any one year, where would you invest most of your money? Investment Portfolio A B C D E Highest one year gain A) $12,000 B) $16,500 C) $21,500 D) $32,700 E) $9,200 Worst one year loss A) $-2,400 B)$-6,400 C) $-11,000 D)$-17,500….. E) $0 ___a) Investment Portfolio A (1 point) ___b) Investment Portfolio B (3 points) ___c) Investment Portfolio C (5 points) ___d) Investment Portfolio D (7 points) ___e) Investment Portfolio E (1 point) (Not an offer nor indicative of any specific investment portfolio. A hypothetical exercise to help assist with determining risk tolerance.) The above two questions are part of a series of questions and just plain listening that you want to review with your advisor at least once per year. There is no right or wrong answer. You are either conservative, aggressive, or somewhere in between. The higher your score, the more aggressive you may be and the more you can afford to defer an annuity to achieve exceptional lifetime income. (Remember, in retirement you need to think “long” with your money, not just “tall.”) An advisor’s job is not just to manage investments—it is to determine the proper allocations to match your time horizon, risk tolerance, and income needs. PS: The term “time horizon” does not refer to biological age. It refers to how soon you will be tapping into investments and savings for steady retirement income. The shorter the time horizon, we obviously must reduce risk and find ways to increase permanent income.

The job of the advisor is to bring it all together into one solid, simplified whole, even if we use sophisticated instruments to carry out each individual task. For your financial plan to be a success for the long run a proper mix of fixed income, instant liquidity, and long term growth is the time-tested and logical solution. Separating each task into a separate “bucket” and using the proper investments for each is the essence of smart planning. This is why and how we built the IQ Wealth Smarter Bucketing Retirement System™. Insure your income, insure your outcomes, invest the rest with purpose.®

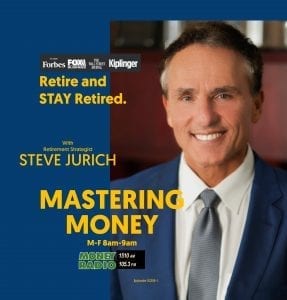

Steve Jurich is a well known financial advisor with offices in Scottsdale, Arizona. He is an Accredited Investment Fiduciary®, a Kiplinger® contributor, and the host of the popular radio show MASTERING MONEY heard daily at 8am and 11am on Money Radio in Phoenix, AM1510 / 105.3 FM. You can also listen to podcasts at RetirementRadioUSA.com